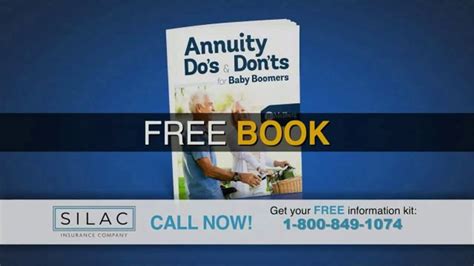

J.D. Mellberg Annuity Do's & Don'ts tv commercials

TV spots

TV commercials J.D. Mellberg Annuity Do's & Don'ts

Advertisers

Advertisers of commercials featuring J.D. Mellberg Annuity Do's & Don'ts

What is J.D. Mellberg Annuity Do's & Don'ts?

J.D. Mellberg is a popular name in the annuity industry and has been providing expert advice on annuities for over three decades. If you are looking to invest in annuities, it is essential to know the dos and don'ts to ensure you make informed decisions.

Here are some J.D. Mellberg Annuity Do's:

1. Do learn about annuities before investing: It's crucial to understand how annuities work before investing your money. Consider seeking advice from a financial advisor or investment professional.

2. Do select an annuity that suits your needs: There are different types of annuities, such as fixed, variable, and indexed annuities. Each type of annuity has its unique features and risks, and it's essential to choose one that meets your financial goals and needs.

3. Do read the terms and conditions carefully: Before investing in an annuity, make sure you have read and understood the terms and conditions of the contract carefully. It's vital to know the fees, penalties, and surrender charges associated with the annuity.

4. Do consider working with a reputable annuity provider: Choose a credible and trustworthy annuity provider with a proven track record in the industry to ensure your investments are safe and secure.

Now, let's look at the Don'ts:

1. Don't invest in annuities you don't understand: If you don't understand how an annuity works or the features it offers, it's best not to invest in it. Make sure you have a clear understanding of what you're getting into and the potential risks involved.

2. Don't invest all your money in one annuity: Avoid putting all your eggs in one basket by investing all your money in a single annuity. Diversify your investments to minimize risk and increase your chances of earning better returns over time.

3. Don't make decisions solely based on sales presentations: Sales presentations for annuities can be very persuasive, but don't base your decisions solely on these. Instead, seek expert advice from a financial professional and conduct your research before making any investment decisions.

4. Don't rush into making investment decisions: Take your time and make well-informed decisions when investing in annuities. Avoid rushing into investment decisions without doing your due diligence.