What is Allstate Identity Protection?

Allstate Identity Protection is a service offered by Allstate, one of the largest insurance companies in the United States. This service helps monitor your identity, privacy, and data to protect you from identity theft. Allstate Identity Protection offers many features such as dark web monitoring, social security number monitoring, reimbursements for stolen funds and expenses related to identity theft. It also provides credit monitoring, alerts, and support in case you become a victim of identity theft.

With Allstate Identity Protection, you can get alerts for any suspicious activity on your financial accounts, credit reports, and personal information. Dark web monitoring feature provides alerts for your personal information on the dark web, which is a frequently used platform for criminals to sell stolen data. Social Security Number monitoring alerts you if your SSN is detected in any unauthorized or illegal activities.

The service also offers recovery support for victims of identity theft. Their agents can help you with identifying fraudulent activities, creating a recovery plan, and filing any complaints or claims. Plus, their reimbursement policy covers the cost of recovering from identity theft, such as legal fees, travel expenses, and lost wages.

Allstate Identity Protection is available to individuals, families, and businesses for a monthly fee, and it's an effective way to stay proactive in securing your information and restoring your identity in case of theft. It's a reliable and trustworthy tool to help you safeguard your identity and protect your peace of mind.

Frequently Asked Questions about allstate identity protection

Allstate Identity Protection is offered and serviced by InfoArmor, Inc., a subsidiary of The Allstate Corporation.

Identity theft insurance is a type of insurance policy that provides financial protection for victims of identity theft. Coverage varies between insurers, but identity theft insurance generally aims to cover costs associated with the recovery process after you have become a victim of ID theft.

Final verdict. Allstate may be a trusted name in auto insurance, but their Identity Protection plans could leave you exposed. Unless you choose the most expensive individual or family plan (the Blue plan) you'll be without some of the credit and cybersecurity features that are most likely to keep you secure.

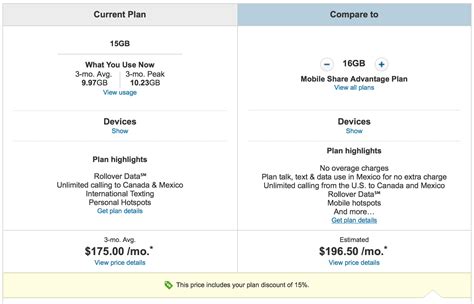

Monthly plan costs

| Allstate identity theft protection plans | Monthly cost |

|---|

| Essentials plan for individuals | $9.99 |

| Essentials plan for families | $18.99 |

| Premier plan for individuals | $17.99 |

| Premier plan for families | $34.99 |

Apr 12, 2023

About your plan

Standard Plans cover product breakdowns and malfunctions during normal use. Accident Plans also cover product breakdowns and malfunctions during normal use as well as life's accidents like drops and spills. NOTE: Neither plan covers intentional damage, loss, theft, or commercial use.

Our Mission

Every day, we share more data in more complex ways. Protecting it requires both state-of-the-art technology and a new approach to thinking about digital relationships. We use powerful, innovative tools but our mission is quite simple: to make your digital life easier, safer, and more rewarding.

Identity theft protection and insurance can protect you from this common, costly type of fraud, and it makes even more sense if: You want to make sure your accounts are well-monitored. You want insurance coverage in case your identity is stolen (coverage will not apply if a known theft has already occurred)

Highlights: Identity theft insurance is a type of insurance policy that provides financial protection for victims of identity theft. Coverage varies between insurers, but identity theft insurance generally aims to cover costs associated with the recovery process after you have become a victim of ID theft.

Allstate® mobile app help

Access your policies, ID cards, pay your bills, report claims, get roadside assistance and more, right when you need it.

Providing protection to help people achieve their hopes and dreams has always been Allstate's purpose. It's the why behind everything we do. The world is unpredictable. When the unexpected happens, we'll be there to face it with you and provide protection to keep your life moving forward.

Also known as service plans or extended warranties, product protection plans can cover defects, accidents, or damage to products and even allow consumers to get them replaced or repaired at no additional cost. Product protection plans are most popular for expensive goods like smartphones and laptops .

Store documents that have your personal information, including financial documents, Social Security, Medicare and credit cards in a safe place at home and at work. Limit what you carry. Leave your social security card and Medicare card at home – unless you are going to need them for a specific reason.

An identity theft protection plan may offer both proactive identity monitoring services as well as remediation assistance and coverage for identity theft expenses.

Here are the best identity theft protection services: Best overall: IdentityForce® Runner-up: PrivacyGuard™ Best for credit monitoring: Experian IdentityWorks℠

Allstate 2 year Electronics Protection Plan. Your item is covered for all mechanical and electrical failures from normal use. Accidents, intentional damage, loss, and theft are not covered.

The company places a strong emphasis on building relationships with its customers and providing them with personalized and high-quality support. Allstate's customer-centric approach is a key differentiator in a highly competitive market, helping the company to retain its existing customers and attract new ones.