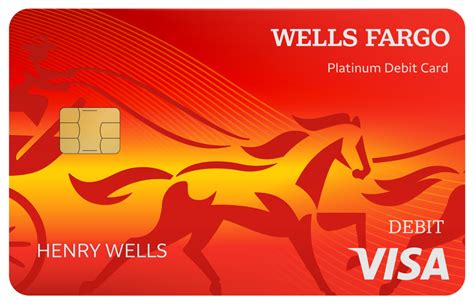

What is Wells Fargo Credit Card?

Wells Fargo is a well-known financial institution that offers a wide range of banking services like savings account, checking account, mortgages, personal loans, credit cards, and more. One of the most popular products offered by Wells Fargo is its credit card.

The Wells Fargo credit card is a versatile card that has numerous features and benefits to offer to its users. One of the most significant benefits of the Wells Fargo credit card is the rewards program. Users can earn rewards points on every purchase they make with the card, which they can then redeem for cash, statement credits, travel, and merchandise.

Additionally, Wells Fargo credit cardholders also enjoy perks such as travel insurance, trip cancellation protection, and emergency cash advance. Moreover, the credit card also offers zero liability protection, ensuring users are not held responsible for unauthorized transactions made with their card.

The Wells Fargo also provides a range of options when it comes to selecting the type of credit card that is best suited to your lifestyle. Whether you are a frequent traveler, a student, a business owner, or someone looking to pay off your debts, Wells Fargo has a credit card that caters to your needs.

Overall, the Wells Fargo credit card is a great option for those who want a credit card that offers a variety of rewards, benefits, and features. Its user-friendly online platform and round-the-clock customer support make it an excellent choice for anyone looking for a dependable and convenient credit card.

Frequently Asked Questions about wells fargo credit card

Compare Bankrate's top Wells Fargo credit cards

| Card name | Best for |

|---|

| Wells Fargo Active Cash Card | Cash rewards |

| Wells Fargo Reflect Card | Balance transfers |

| Wells Fargo Autograph Card | Rewards category variety |

| Hotels.com Rewards Visa® Credit Card | Occasional hotel guests |

Oct 3, 2023

A credit card generally operates as a substitute for cash or a check and most often provides an unsecured revolving line of credit. The borrower is required to pay at least part of the card's outstanding balance each billing cycle, depending on the terms as set forth in the cardholder agreement.

Wells Fargo Platinum Visa® Card Guide to Benefits

- Emergency Cash Disbursement and Card Replacement.

- Travel and Emergency Assistance Services.

- Auto Rental Collision Damage Waiver.

- Roadside Dispatch®

- $150,000 Worldwide Automatic Common Carrier Travel Accident Insurance.

- Additional Terms.

With a Wells Fargo rewards-based credit card, you can earn rewards on virtually all purchasesFootnote 1 1, including everyday items like groceries or gas, or on bigger items, like when you book travel, or stay at a hotel. Visit Wells Fargo Rewards to learn more.

Today, Wells Fargo is a leading financial services company with approximately $1.9 trillion in assets. In the U.S., it serves one in three households and more than 10% of small businesses, and is a leading middle-market banking provider.

Wells Fargo is among the top five banks in the United States. The bank makes money by lending out at a higher rate than it borrows. Wells Fargo operates four segments including Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

Credit Products

- Consumer loan. Consumer loan is a credit, lent to an individual for personal usage for purchasing specific item or service.

- Mortgage.

- Auto Loan.

- Installment.

- Overdraft.

- Credit Card.

There are many different forms of credit. Common examples include car loans, mortgages, personal loans, and lines of credit. Essentially, when the bank or other financial institution makes a loan, it "credits" money to the borrower, who must pay it back at a future date.

About Wells Fargo

Wells Fargo works to create positive social impact in the communities it serves by supporting housing affordability, small business growth, financial health, and a low-carbon economy.

Building credit, earning cash back and benefiting from fraud protection are just a few of the many advantages of using credit cards.

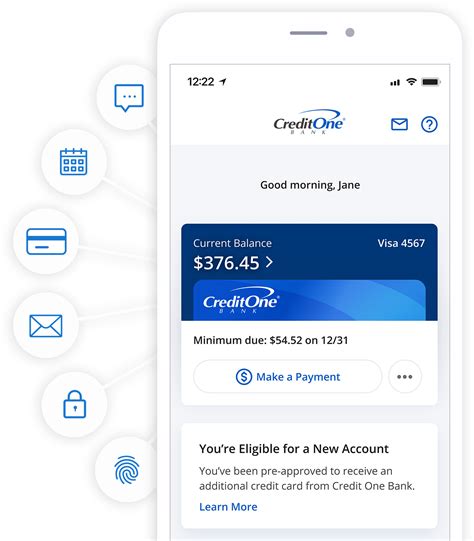

Overview. Wells Fargo may be a good fit for those who want access to a large network of branches and ATMs as well as a full-featured mobile banking app. Those seeking out high savings rates may want to consider other options.

Wells Fargo offers options that may help you reach your financial goals. With more than 150 years of experience, we're focused on helping you figure out the financial solutions for every stage of your life. We offer convenient ways to help you manage your money, protect your finances, and reach your financial goals.

Popular FAQs

- Checking.

- Savings & CDs.

- Credit Cards.

- Home Loans.

- Personal Loans.

- Auto Loans.

- Premier.

- Education & Tools.

Today, Wells Fargo is a leading financial services company with approximately $1.9 trillion in assets. In the U.S., it serves one in three households and more than 10% of small businesses, and is a leading middle-market banking provider.

What are the 4 types of credit cards? The types of credit cards are categorised as per their used cases. Four types of credit cards include travel credit cards, business credit cards, reward credit cards, and shopping credit cards among others.

Four Common Forms of Credit

- Revolving Credit. This form of credit allows you to borrow money up to a certain amount.

- Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.

- Installment Credit.

- Non-Installment or Service Credit.