What is Amica Mutual Insurance Company Auto Insurance?

Amica Mutual Insurance Company is a well-known provider of auto insurance in the United States. Founded in 1907, the company has established itself as a reliable and trustworthy insurance provider that prioritizes customer satisfaction and peace of mind.

One of the standout features of Amica's auto insurance policies is the company's commitment to providing comprehensive coverage options. This means that customers can choose from a range of coverage types that fit their budget and individual needs, including liability coverage, collision coverage, and comprehensive coverage.

In addition to offering a variety of coverage options, Amica also provides a range of discounts that can reduce the cost of auto insurance premiums. Customers can take advantage of discounts for safe driving, multiple vehicles, bundling policies, and more.

Another factor that sets Amica apart from other insurance providers is their customer service. The company has consistently been ranked as one of the top customer service providers in the insurance industry, with a commitment to providing timely and helpful support to policyholders.

Overall, Amica Mutual Insurance Company's auto insurance policies offer comprehensive coverage options, competitive pricing, and top-notch customer service. For those looking for a reliable and trustworthy auto insurance provider, Amica is definitely worth considering.

Frequently Asked Questions about amica mutual insurance company auto insurance

Amica was founded as the Automobile Mutual Insurance Company of America by A.T. Vigneron in 1907 and originally offered auto, fire and theft insurance.

Amica is owned by Amica policyholders, since it is a mutual insurance company and its shares are not available to investors on the public market. Among the 10 largest car insurance companies in the U.S., four are mutual insurance companies.

Amica Insurance's revenue is $5.4 billion.

Amica Insurance peak revenue was $5.4B in 2022. Amica Insurance has 3,781 employees, and the revenue per employee ratio is $1,428,193.

Amica is a global manufacturer of household appliances headquartered in Wronki, in western-central Poland. The company produces refrigerators, washing machines and dishwashers, vacuum cleaners, microwave ovens, electric stoves, kettles for the kitchen under the brands Hansa, CDA, Gram.

- Balance Sheets. 2022. 2021.

- Assets: Bonds and debt securities.

- $ 2,843. $ 2,860.

- Stocks. 1,237. 1,790. Cash and short-term investments. 105. Other invested assets. 543. 527. Premiums receivable. 442. 423. Other assets. 249. 196. Total assets.

- $ 5,419. $ 5,829.

- Liabilities: Reserves for losses and loss expenses.

- $ 1,501. $ 1,306.

Empathy is our best policy

Empathy is our best policy.

Key Takeaways. An insurance company owned by its policyholders is a mutual insurance company. A mutual insurance company provides insurance coverage to its members and policyholders at or near cost. Any profits from premiums and investments are distributed to its members via dividends or a reduction in premiums.

A mutual insurance company is an insurer that provides collective self-insurance to its Members. It has no shareholders and is owned and controlled by its Members.

Northwestern Mutual

Northwestern Mutual is the largest life insurance company, according to 2022 NAIC data, holding a little over 7 percent of market share.

Who are the largest property and casualty insurance companies? State Farm is the largest property and casualty insurance in the United States, with more than $70 billion in premiums in 2021.

We are recognised as the most trusted household appliance brand in Europe, and are certified by the ISO for our quality.

It might be small, but the Amica is happy to take on long journeys in its stride. For something designed to feel at home in the city, that's the best compliment you can pay the little Hyundai. Aside from its modest amount of safety kit, this is a well-rounded car that's easy to drive, park and own.

By assets

| Rank | Company | Total assets (US$ Billion) |

|---|

| 1 | Allianz | 1,261.9 |

| 2 | Axa | 950.6 |

| 3 | Prudential Financial | 940.7 |

| 4 | Ping An Insurance | 883.9 |

OUR CORE VALUES

- Professionalism. We commit to do things right the first time, with integrity and competence.

- Efficiency. We commit to utilizing all our resources optimally to enhance the speed of service delivery, reduce wastage and costs.

- Teamwork.

- Innovation.

- Simplicity.

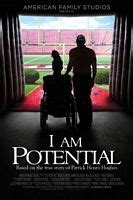

Amica's Mission Statement

"Our mission is to create peace of mind and build enduring relationships."

Because of Amica's high J.D. Power auto claims satisfaction score and low average amount of customer complaints with the National Association of Insurance Commissioners, Amica could be a great choice for drivers looking for top-notch customer service.