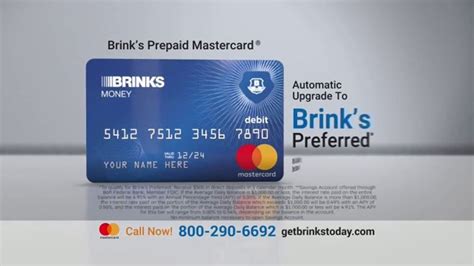

What is Mastercard Debit Touch Card?

The Mastercard Debit Touch Card is a new type of payment card that was introduced by Mastercard in late 2021. The card is designed to be more accessible and user-friendly, particularly for people who are visually impaired or have other disabilities.

One of the key features of the Mastercard Debit Touch Card is the use of tactile notches on the card surface. These notches make it easier for cardholders to distinguish between their different payment cards, such as debit and credit, and also to locate the right end of the card when inserting it into a payment terminal. The notches are rounded for debit cards and squared for credit cards, making them easy to identify by touch.

The Mastercard Debit Touch Card is also designed to be compatible with contactless payment systems, which are becoming increasingly popular in many countries around the world. With contactless payment, users can simply tap their payment card on a compatible terminal to make a transaction, without the need to insert the card or enter a PIN. This feature is particularly useful for people who may have difficulty entering a PIN, such as those with arthritis or other mobility issues.

Overall, the Mastercard Debit Touch Card represents a significant step forward in making payment cards more accessible and user-friendly for all consumers. With its tactile notches and contactless payment capabilities, it is a great option for people who want a payment card that is both easy to use and easy to identify.

Frequently Asked Questions about mastercard debit touch card

Mastercard's Touch Card is an innovative solution to a longstanding problem in the financial technology industry. By using different notches to distinguish between cards, Mastercard has created a product that is accessible to everyone, including people with vision impairment.

Key Features and Benefits of Mastercard Debit Card

Permits Cash Withdrawal: Cardholders can buy at any retail store and withdraw cash from any ATM. Also, when you enable international use on the card, you can use ATMs worldwide.

Key points about credit and debit cards

A debit card is linked to your bank account. It's usually your money that you're spending or withdrawing, unless you have an overdraft, which is a type of credit linked to your account. A credit card is a standalone account giving you access to a pre-agreed credit limit.

touch Visa Card offers you the convenience of a payment card in fresh $, that can be used locally & internationally, and that will instantly grant you FREE MBs on your touch line.

1. When you tap your contactless card or bring it near the merchant's point-of-sale terminal, it generates a unique cryptographic code to initiate the transaction. 2. The card reader then transmits the data to a card processing network such as American Express, Mastercard or VISA.

How do I make purchases using my contactless card? Expand

- Hold your card within 1–2 inches of the Contactless SymbolOpens Dialog on the terminal.

- Tap or hold your card flat over the Contactless Symbol, facing up, when prompted by the cashier or terminal.

- Your payment should be completed in seconds.

There is no major difference between a Visa and a MasterCard; they both have similar functioning and work as an ATM card.

Mastercard credit cards are broken down into three tiers, including Standard, World and World Elite. Each tier comes with different associated benefits and perks, which we'll explore below.

Best Mastercard Debit Card Providers in India

- IDBI Mastercard Classic Debit Card.

- BOI Master Titanium Debit card.

On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders.

A contactless credit card uses RFID technology to enable you to hover or tap a card over a card terminal as a means of conducting a transaction. The card emits short-range electromagnetic waves containing your credit card information to be captured by the point-of-sale system and processed to complete the transaction.

Since the chips are virtually impossible to tamper with or clone, EMV cards are infinitely less vulnerable to counterfeit fraud than magnetic stripe cards. The EMV standard continuously evolves to include new security defence mechanisms, such as Dynamic Data Authentication (DDA).

All you need to do is open your mobile wallet, choose a payment card and hold your device close to the contactless symbol on the ATM. QR codes. The ATM will display a QR code on the screen, which you'll need to scan using your mobile device.

A contactless credit card uses RFID technology to enable you to hover or tap a card over a card terminal as a means of conducting a transaction. The card emits short-range electromagnetic waves containing your credit card information to be captured by the point-of-sale system and processed to complete the transaction.

When you open a checking account at a bank or credit union, you usually get a debit card. A debit card lets you spend money from your checking account without writing a check. When you pay with a debit card, the money comes out of your checking account immediately. There is no bill to pay later.

Standard Mastercard benefits

- Zero liability protection.

- Mastercard Global Service.

- Mastercard ID Theft Protection.

- ShopRunner membership.

- Priceless Golf.

- Complimentary professional travel services.

- Mastercard hotel stay guarantee.

- Mastercard lowest hotel rate guarantee.