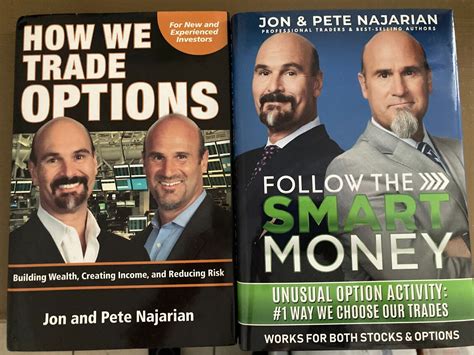

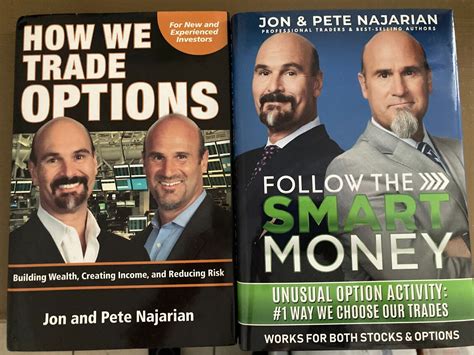

What is OptionMonster Media Jon & Pete Najarian "How We Trade Options"?

OptionMonster Media is a financial media company founded by Jon and Pete Najarian. The Najarian brothers are well-known in the trading community for their experience and expertise in options trading. In their book "How We Trade Options," the Najarians share their insights and strategies for successful trading.

The book is designed to help novice traders understand the basics of options trading, as well as to provide more experienced traders with strategies for improving their profits. The Najarians offer valuable advice on how to understand market trends, identify key indicators, and minimize risk. They also provide numerous examples of successful trades, which help readers gain a deeper understanding of how options trading works in practice.

One of the key topics covered in the book is the concept of "unusual options activity." The Najarians leverage their experience as traders to identify when big institutional players are placing large trades. By keeping an eye on these activities, they are able to anticipate movements in the market and take advantage of profitable trading opportunities.

Overall, "How We Trade Options" is a valuable resource for anyone looking to improve their options trading skills. The Najarians' expertise and experience make them well-equipped to advise others on effective trading strategies. Furthermore, their approachable writing style and use of real-world examples make the book both informative and engaging. If you're interested in options trading, "How We Trade Options" is definitely worth a read.

Frequently Asked Questions about optionmonster media jon & pete najarian "how we trade options"

How to trade options in four steps

- Open an options trading account. Before you can start trading options, you'll have to prove you know what you're doing.

- Pick which options to buy or sell.

- Predict the option strike price.

- Determine the option time frame.

The Best Options Trading Books:

- 1- Options as a Strategic Investment.

- 2- Options Volatility and Pricing: Advanced Trading Strategies and Techniques.

- 3- Options Trading Crash Course.

- 4- Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits.

Basics of Option Profitability

A call option buyer stands to make a profit if the underlying asset, let's say a stock, rises above the strike price before expiry. A put option buyer makes a profit if the price falls below the strike price before the expiration.

Here are five of the most notable titles:

- Options as a Strategic Investment by Lawrence McMillan.

- Option Volatility and Pricing by Sheldon Natenberg.

- Fundamentals of Futures and Options Markets by John Hull.

- Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits by Dan Passarelli.

Intraday Option Strategies-

- Consider the following factors before executing the trade:

- Step 1: Identify potential stock/index for day-trading.

- Step 2: Choose the right options.

- Step 3: Determine entry and exit points.

- Step 4: Place the trade.

- Step 5: Monitor the trade.

- Step 6: Exit the trade.

- Conclusion.

Option contracts are traded either; on a public stock exchange (also known as ETO's (Exchange Traded Options)) implicity agreed between two parties (also known as OTC's (Over The Counter options)).

The best way to learn technical analysis is to gain a solid understanding of the core principles and then apply that knowledge via backtesting or paper trading. Thanks to the technology available today, many brokers and websites offer electronic platforms that offer simulated trading that resemble live markets.

To understand options, you just need to know a few key terms:

- Derivative. Options are what's known as a derivative, meaning that they derive their value from another asset.

- Call option and put option.

- Strike price and expiration date.

- Premium.

- Intrinsic value and extrinsic value.

- In-the-money and out-of-the-money.

An option chain trading strategy can be formulated by seeing accumulations in OI (open interest) and volumes in various option strikes. You should note, here, that open interest implies the number that tells you how many options or futures contracts are presently outstanding/open, within the market.

Options allow the investor to trade not only stock movements but also the passage of time and movements in volatility. Most stocks don't have large moves most of the time. Only a few stocks actually move significantly, and they do it rarely.

Options allow traders to make a leveraged bet on what might happen next with a security's price. Each standard option controls 100 shares and has a designated strike price and expiration date. Option contract holders aren't required to exercise their rights to buy or sell shares.

A Bull Call Spread is made by purchasing one call option and concurrently selling another call option with a lower cost and a higher strike price, both of which have the same expiration date. Furthermore, this is considered the best option selling strategy.

A day trader has to complete the trade within a working day. If you are trading in options, you must keenly watch for movements in the stock price. This will allow you to buy or sell the assets at the optimum time. But what if you do not wish to buy or sell right away?

The best times to day trade

Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from 9:30 a.m. to about noon ET, and then in the last hour of trading before the close at 4 p.m. ET.

Options can be less risky for investors because they require less financial commitment than equities, and they can also be less risky due to their relative imperviousness to the potentially catastrophic effects of gap openings. Options are the most dependable form of hedge, and this also makes them safer than stocks.

Some of the most commonly used options trading indicators include the following:

- Average Directional Index (ADX)

- Anchored VWAP.

- Bollinger Bands.

- MACD.

- RSI.