What is Capital One (Credit Card) Quicksilver?

Capital One Quicksilver is a popular credit card that offers users an array of benefits. With Quicksilver, cardholders can earn cash back on every purchase they make, which can be redeemed for statement credits, checks, or gift cards. The card also features a generous rewards program that allows users to earn unlimited 1.5% cashback on all purchases.

In addition to its rewards program, Quicksilver offers a host of other perks. For example, this credit card boasts no annual fee, which makes it an ideal option for consumers looking for a budget-friendly credit card. Furthermore, Quicksilver offers 0% introductory APR on purchases and balance transfers for the first 15 months.

Another unique feature of the Quicksilver card is its security measures. Capital One provides cardholders with fraud liability protection and the ability to monitor their credit score for free. This added layer of security gives users peace of mind when making purchases and goes a long way in protecting against identity theft and unauthorized usage.

Finally, Capital One Quicksilver provides users with access to several exclusive experiences and services, such as premium dining events, sporting events, and travel concierge services. These exclusive offerings add additional value to the card and are often a great way to get the most out of Quicksilver.

Overall, Capital One's Quicksilver credit card is an excellent option for consumers looking for a rewards card that offers convenience, security, and valuable benefits. With its generous rewards program and unique perks, Quicksilver continues to be one of the most popular credit cards on the market.

Frequently Asked Questions about capital one (credit card) quicksilver

The Capital One Quicksilver Cash Rewards Credit Card makes things easy by offering a flat 1.5% cash back rate on every purchase you make. Keep in mind, though, that if you incur interest charges, you may have a harder time getting value out of the card.

What kind of card is the Capital One Quicksilver Card? The Capital One Quicksilver Cash Rewards Credit Card is a 0% APR credit card with rewards. It offers 1.5 - 5% cash back on purchases and has an introductory purchase APR of 0% for 15 months.

The card earns 1.5% cash back on all purchases, and you'll also get introductory incentives as well as travel-friendly features. Melissa Lambarena is a senior writer on the credit cards team at NerdWallet.

Earning Cash Back on Every Purchase

Many cards require a minimum rewards redemption, but the Quicksilver allows you to redeem rewards in any amount. If you want no-hassle cash-back rewards, the Capital One Quicksilver Cash Rewards Credit Card is a good choice. The Capital One Platinum Credit Card does not earn rewards.

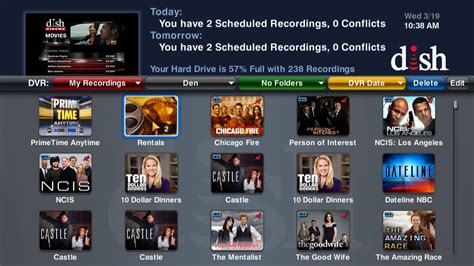

Like all Capital One credit cards, the QuicksilverOne lets international travelers spend freely with no foreign transaction fees. The annual fee for the Capital One QuicksilverOne card is $39, see rates and fees.

Yes, you can use your Capital One QuicksilverOne Cash Rewards Credit Card anywhere Mastercard is accepted. Apart from Mastercard's extensive worldwide acceptance, the card also features a $0 foreign transaction fee. This makes it a good travel companion and ideal for online purchases through international merchants.

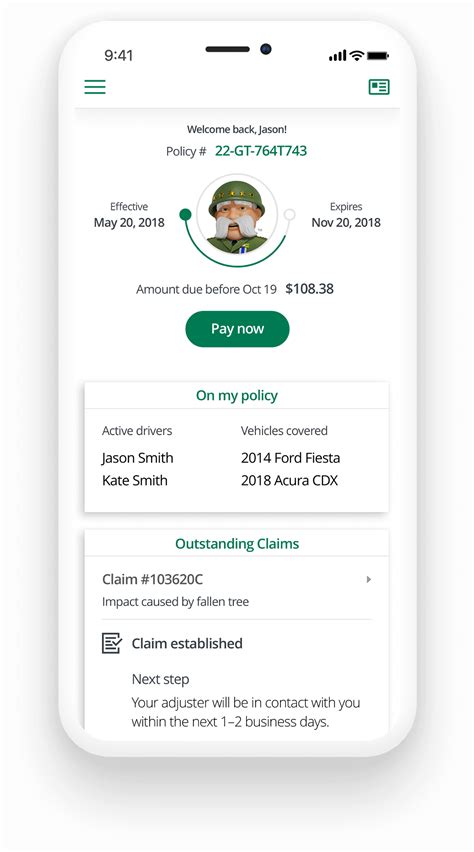

For example, Capital One is a credit card issuer that works with Mastercard and Visa. Capital One offers card benefits and tools like the Capital One Mobile app and Eno, your Capital One assistant. But eligible cardholders can also access benefits from Mastercard or Visa.

$1,000

The minimum credit limit for the Quicksilver card is $1,000. Your history with the Quicksilver card will be evaluated for a higher credit limit or upgrade after 6 months of positive history.

The Capital One Quicksilver credit limit depends on your income, creditworthiness and payment history, which are evaluated once you apply for the card. According to anecdotal reports, the card's credit limit can be as low as $750 and as high as $10,000.

two

Capital One offers several variants of its flagship 1.5% cash back credit cards, two of which are the Capital One Quicksilver Cash Rewards Credit Card and Capital One QuicksilverOne Cash Rewards Credit Card.

The Quicksilver card is a solid flat-rate cash back card for cardholders who value simplicity, minimal fees and low-maintenance rewards. It could also be a good choice if you're looking for an easy-to-earn sign-up bonus or intro APR to chip away at debt or finance new purchases.

The Capital One Quicksilver Cash Rewards Credit Card is a good option for the fee-averse. It charges an annual fee of $0. And because it has no foreign transaction fees, it can be a good option to take with you when traveling internationally.

Like all Capital One credit cards, the QuicksilverOne lets international travelers spend freely with no foreign transaction fees. The annual fee for the Capital One QuicksilverOne card is $39, see rates and fees.

The Capital One Debit Mastercard® is directly connected to your 360 Checking account. Why contactless? The contactless 360 Checking debit card is faster and safer than paying with cash - plus, you don't need to touch surfaces or leave your card inserted. Just tap, pay and be on your way.

Capital One offers about 30 different credit cards; anyone looking for business rewards, travel rewards, a student credit card, or to rebuild their credit can find a Capital One card that suits them.

The Capital One Quicksilver Cash Rewards Credit Card is a good option if you value the simplicity of earning a flat rate on all your purchases. You'll get 1.5% cash back on nearly every purchase, without a bunch of bonus categories to remember or spending limits to keep track of.