What is Farmers Insurance Auto Insurance?

Farmers Insurance is a company that provides auto insurance services to millions of drivers across the United States. Farmers Insurance Auto Insurance is a comprehensive policy that covers a range of damages caused by accidents and incidents on the road.

Farmers Insurance Auto Insurance offers liability coverage, which protects you if you are at fault for an accident and someone else is injured or their property is damaged. This policy also includes collision coverage, which pays for damages to your car in the event of an accident. Additionally, Farmers Insurance Auto Insurance provides comprehensive coverage, which covers non-collision-related damages such as theft, fire, and natural disasters.

Farmers Insurance Auto Insurance also provides a unique feature called "New Car Replacement," which is available for new vehicles. This feature covers the cost of replacing a new vehicle that is totaled within the first two years of ownership. The company also offers "Accident Forgiveness," which means that your rates will not increase after your first at-fault accident, provided that you meet certain criteria.

Farmers Insurance Auto Insurance also provides various discounts, including safe driver discounts and multi-policy discounts for customers who also have home or life insurance policies with the company. In addition, there is a discount for customers who pay their full premiums upfront, and a discount for those who have anti-theft devices installed in their vehicles.

Overall, Farmers Insurance Auto Insurance offers extensive coverage options, convenient features, and a range of discounts to meet the unique needs of its customers.

Frequently Asked Questions about farmers insurance auto insurance

Full Review

Farmers earned 4.5 stars out of 5 for overall performance. NerdWallet's ratings are determined by our editorial team. The scoring formula takes into account consumer experience, complaint data from the National Association of Insurance Commissioners and financial strength ratings.

#1 State Farm: Editor's Choice

State Farm is the nation's largest car insurance company, accounting for 16.8% of all auto policies sold. The company maintains a stellar customer service reputation that's backed by both industrywide studies and many positive reviews.

We provide an all-around better insurance experience for California based residents by creating an environment that truly puts people first, and prioritizes accommodating their wants, needs, and personal preferences.

Farmers offers the New Car Pledge ®, a guarantee for newly purchased vehicles. We'll replace it with a new one of the same make and model, at full market value without depreciation, as long as the car has less than 24,000 miles and is a maximum of two model years old.

Farmers is among the most expensive car insurance companies we analyzed. Good drivers can expect to pay $2,381 a year for full coverage. Drivers of the same profile can save over $750 with similar coverage from Auto-Owners - or even more at USAA, if they're eligible.

Farmers Is Cheaper for Good Drivers

Usually, good drivers pay some of the lowest insurance premiums, but Allstate's rates are higher than Farmers', and the national average. Farmers' rates are higher than Allstate's but still higher than the national average.

State Farm is the cheapest car insurance company overall, with an average rate of $37 a month for minimum coverage.

These are the most expensive states for full-coverage car insurance:

- Michigan: $3,785 per year.

- Connecticut: $2,999 per year.

- Florida: $2,947 per year.

- New York: $2,783 per year.

- Louisiana: $2,783 per year.

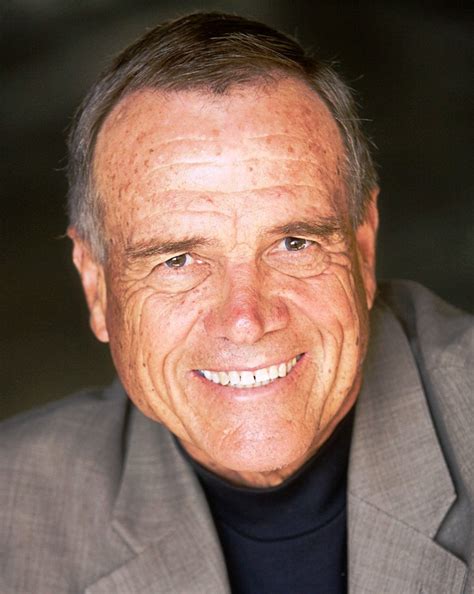

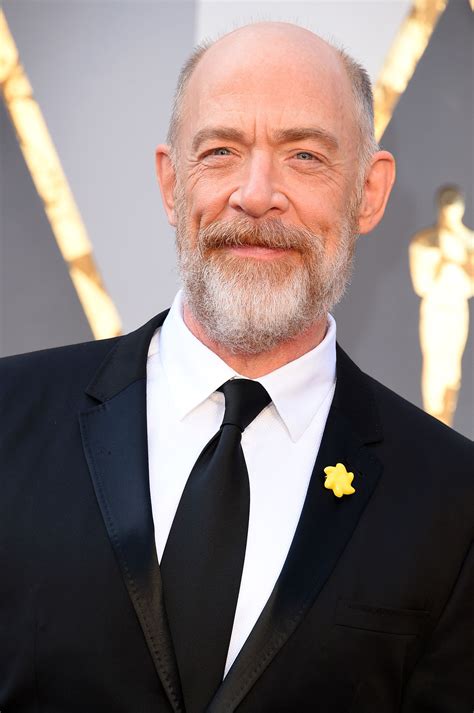

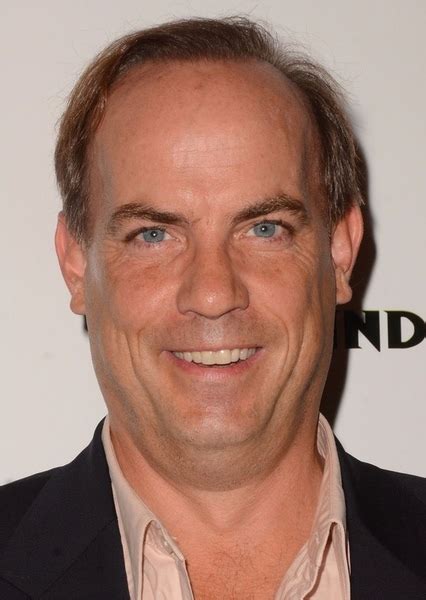

They feature stories of animals gone wild, bizarre car accidents, and claims from homeowners that make it into the Farmer's “Hall of Claims.” Each commercial concludes with the simple punch line: “We know a thing or two, because we've seen a thing or two.”

We protect assets and minimize risk to help our customers avoid financial hardship. We strive to be the partner of choice for customers, insurance carriers and employees looking for long-term relationships built on a foundation of trust.

MetLife Inc.

and Farmers Exchanges have completed their acquisition of MetLife Inc.'s U.S. property/casualty business for $3.94 billion, assuming 2.4 million in-force policies, the companies announced April 7.

Zurich Insurance GroupZürich Versicheru... AG

Farmers Insurance Group/Parent organizations

Farmers Is Cheaper for Good Drivers

Usually, good drivers pay some of the lowest insurance premiums, but Allstate's rates are higher than Farmers', and the national average. Farmers' rates are higher than Allstate's but still higher than the national average.

$89,211

Farmers Insurance Agent Salary in California

| Annual Salary | Hourly Wage |

|---|

| Top Earners | $89,211 | $43 |

| 75th Percentile | $67,400 | $32 |

| Average | $52,655 | $25 |

| 25th Percentile | $41,500 | $20 |

USAA, Auto-Owners, Westfield, Geico and Travelers are the overall cheapest car insurance companies nationwide, according to Forbes Advisor's analysis.

Based on our data, we found The Hanover Insurance Group and United Automobile Insurance Co. typically offer the most expensive liability car insurance on average.