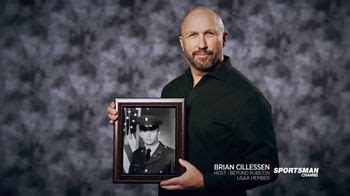

Gerber Life Insurance Grow-Up Plan TV commercial - Foundation Feat. Steve Wilkos

Advertisers

Advertisers of the Gerber Life Insurance Grow-Up Plan TV Spot, 'Foundation' Feat. Steve Wilkos

Gerber Life Insurance

Gerber Life Insurance Company is a leading provider of family life insurance products. For over 50 years, Gerber Life has been dedicated to helping families secure their financial future by providing...

What the Gerber Life Insurance Grow-Up Plan TV commercial - Foundation Feat. Steve Wilkos is about.

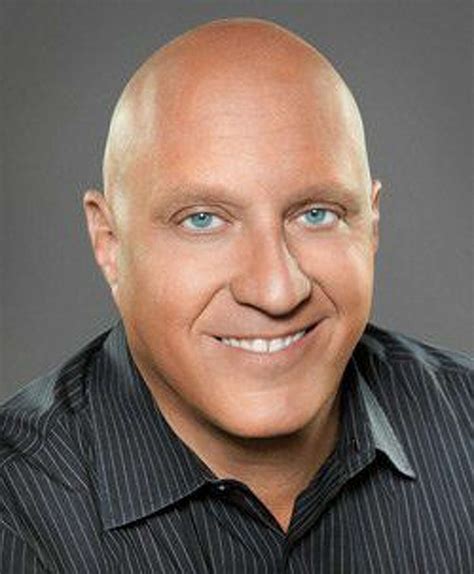

The Gerber Life Insurance Grow-Up Plan TV Spot, 'Foundation' features renowned TV personality Steve Wilkos promoting the popular savings and protection plan for children.

The ad opens with innocuous shots of children playing and smiling, set against a backdrop of a heartwarming piano melody. Steve Wilkos then appears on-screen, serving as the spokesperson for Gerber Life Insurance, and highlighting the benefits of the Grow-Up Plan.

The primary message of the ad is the importance of planning for your child's future, particularly in the face of unexpected circumstances. The Grow-Up Plan is positioned as a means of providing a safety net for families by offering protection against accidents, illness or death. It also offers enduring financial savings, with a guaranteed payout when the policy matures which can be used for college tuition, business ventures, or other expenses.

Throughout the ad, Steve Wilkos emphasizes the unique advantages of Gerber's Grow-Up Plan, and the peace of mind that comes with knowing that your child is protected and prepared for whatever life may throw their way.

The commercial ends with Wilkos encouraging parents to secure the financial future of their children, saying that it's never too early to get started. He signs off with the tagline "When you're a parent, the future is worth protecting. Gerber Life's Grow-Up Plan...because tomorrow is worth it."

Overall, the Gerber Life Insurance Grow-Up Plan TV Spot, 'Foundation' is a compelling call to action for parents to make smart choices regarding their children's financial futures. With a reassuring message and emotive visuals, the ad is effective in conveying the importance of the Gerber Life Grow-Up Plan in securing your child's foundation.

Gerber Life Insurance Grow-Up Plan TV commercial - Foundation Feat. Steve Wilkos produced for Gerber Life Insurance was first shown on television on October 25, 2016.

Frequently Asked Questions about gerber life insurance grow-up plan tv spot, 'foundation' feat. steve wilkos

Videos

Watch Gerber Life Insurance Grow-Up Plan TV Commercial, 'Foundation' Feat. Steve Wilkos

Unfortunately we were unable to find any suitable videos in the public domain. Perhaps the video of this TV commercial has not been preserved. If you know the link to this commercial, you can send it to us using a special form.

Actors

Actors who starred in Gerber Life Insurance Grow-Up Plan TV Spot, 'Foundation' Feat. Steve Wilkos

Products

Products Advertised

TV commercials

Similar commercials