What the Franklin Templeton Investments TV commercial - Whats Next is about.

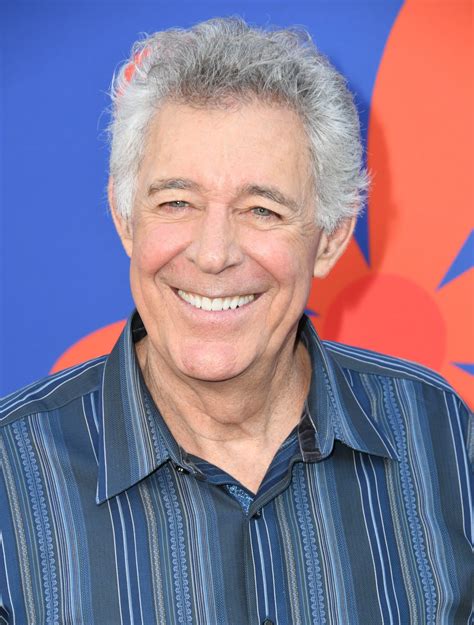

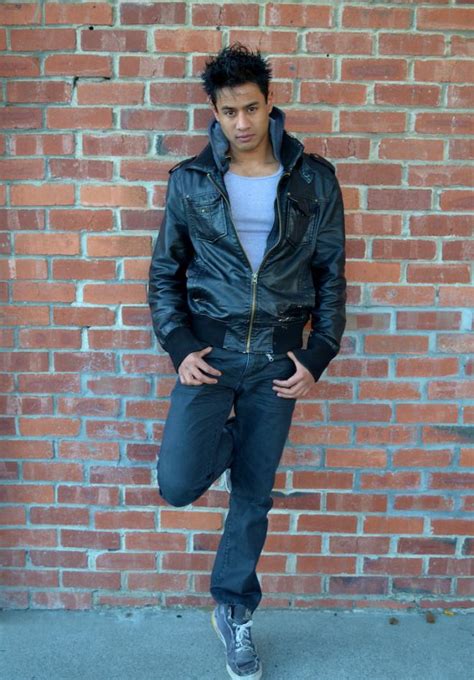

The Franklin Templeton Investments TV spot "What's Next" is a well-crafted and engaging commercial that seeks to inspire viewers to think about their future and take action to prepare themselves financially. The spot features a diverse group of people from different walks of life, all of whom are shown in contemplative poses as they ponder the question "What's next?"

The spot then shifts to scenes of people taking steps to prepare themselves for the future. There are shots of a woman at her desk researching investment options, a couple talking to a financial advisor, and a man looking at retirement plan options on his laptop. The spot ends on an upbeat note, with people out enjoying the world and their financial security, all set to a catchy and upbeat soundtrack.

Overall, the Franklin Templeton Investments TV spot "What's Next" does an excellent job of subtly implanting the idea that preparing for one's financial future is important, while also making the process seem engaging and fun. The spot's use of vibrant visuals and upbeat music will likely engage a wide range of viewers, while the emphasis on financial planning and investment is likely to resonate with those who are looking to secure their long-term financial future.

Franklin Templeton Investments TV commercial - Whats Next produced for

Franklin Templeton Investments

was first shown on television on January 17, 2015.

Frequently Asked Questions about franklin templeton investments tv spot, 'what's next'

We create a disciplined and systematic approach to active fixed income management integrating top-down macroeconomic views, bottom-up fundamental research and quantitative science.

Everything we do at Franklin Templeton is focused on delivering our clients better outcomes. And that's why millions of clients in more than 155+ countries have entrusted us with their investments, making us one of the world's largest independent asset managers.

As of June 15, 2023, all performing assets in Income Opportunities, Low Duration, Dynamic Accrual, Ultra Short Bond and Credit Risk Fund stand extinguished and 100% of the AUM of the schemes stand distributed. There is only one issuer remaining to be liquidated in the Short Duration Fund.

The Franklin Growth Fund has a long-term track record of delivering returns slightly higher than those of the Standard & Poor's 500 index, as well as its Morningstar category, Large Growth. The bulk of its portfolio is made up of mature companies, but there is plenty of room for newer, less-established firms.

Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a CAGR/Annualized return of 15.2% since its launch. Ranked 11 in Small Cap category. Return for 2022 was 3.6% , 2021 was 56.4% and 2020 was 18.7% .

PTI. SBI Funds Management Ltd on Tuesday said it has completed the liquidation of assets in the six shuttered debt schemes of Franklin Templeton Mutual Fund and distributed Rs 27,508 crore to the latter's unitholders.

Investors were left shaken when Franklin Templeton took the unprecedented decision to wind up six of its debt funds on 23 April 2020. A crippling market dislocation, fed by the onset of the Covid pandemic, had sucked out liquidity from the funds' underlying holdings.

One of the most profitable hedge funds of all times, Citadel generated $16 billion in profits for its investors in 2022, and earned $65.9 billion in net gains since 1990, making it the top-earning hedge fund ever.

It was only when Franklin Templeton India mutual fund suddenly wound up six of its open-ended debt funds – with assets worth Rs 25,215 crore as of April 23, 2020 – that investors realised that debt funds could be as risky as equity funds, or even riskier.

“Franklin's equity funds have steadily lost to peers for multiple reasons. Some of them lost out on being too value-conscious and missing out on substantial rallies in a narrow universe of stocks while few others lost out on top concentrated calls not working for a good while,” the note said.

The units in all six funds now stand extinguished, with orderly liquidation of all performing assets. Having got their money back, investors can finally breathe easy.

Franklin Templeton Investments has an overall rating of 3.9 out of 5, based on over 2,009 reviews left anonymously by employees. 74% of employees would recommend working at Franklin Templeton Investments to a friend and 63% have a positive outlook for the business.

![Jaguar TV Spot, 'Ultimate Joyride' [T1] Jaguar TV Spot, 'Ultimate Joyride' [T1]](https://connect4productions.com/image/Jaguar%20TV%20Spot,%20%27Ultimate%20Joyride%27%20%5BT1%5D/tv)

![Lexus Special July 4th Offer TV Spot, 'To Err Is Human' [T2] Lexus Special July 4th Offer TV Spot, 'To Err Is Human' [T2]](https://connect4productions.com/image/Lexus%20Special%20July%204th%20Offer%20TV%20Spot,%20%27To%20Err%20Is%20Human%27%20%5BT2%5D/tv)

![Jeep Labor Day Sales Event TV Spot, 'Traffic Jams' [T2] Jeep Labor Day Sales Event TV Spot, 'Traffic Jams' [T2]](https://connect4productions.com/image/Jeep%20Labor%20Day%20Sales%20Event%20TV%20Spot,%20%27Traffic%20Jams%27%20%5BT2%5D/tv)