Citi Double Cash TV commercial - Mom

Advertisers

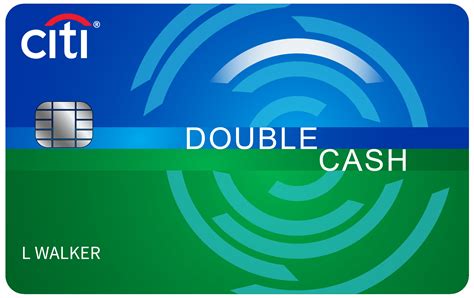

Advertisers of the Citi Double Cash TV Spot, 'Mom'

Citi (Credit Card)

Citi, also known as Citigroup, is a globally recognized financial institution that offers a wide range of services, including credit cards. As one of the largest banking organizations in the world, Ci...

What the Citi Double Cash TV commercial - Mom is about.

The Citi Double Cash TV Spot, 'Mom', is a heartwarming commercial that showcases the unique bond between a mother and her daughter. The commercial opens with the mother and daughter standing in the living room, with the mother holding a framed photo of her daughter from when she was a little girl. As they reminisce about the past, the mother expresses her joy and pride in seeing her daughter grow and become successful.

The conversation then shifts to the topic of finances, with the mother advising her daughter to be responsible and mindful of her spending as she navigates through life. She then introduces the Citi Double Cash credit card, explaining how it offers cash back on every purchase, with no limits or categories to worry about.

The commercial ends with the mother and daughter sharing a warm hug, as the daughter thanks her mom for the advice and the valuable lesson on financial responsibility. The message of the commercial is clear - that responsible spending is an important aspect of adult life, and the Citi Double Cash card can help with that.

Overall, the Citi Double Cash TV Spot, 'Mom' is a touching and relatable commercial that emphasizes the importance of financial responsibility and the power of cash back rewards. It showcases a beautiful relationship between a mother and her daughter, and how even simple things like financial advice can help strengthen that bond.

Citi Double Cash TV commercial - Mom produced for Citi (Credit Card) was first shown on television on May 29, 2016.

Frequently Asked Questions about citi double cash tv spot, 'mom'

Videos

Watch Citi Double Cash TV Commercial, 'Mom'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in Citi Double Cash TV Spot, 'Mom'

Products

Products Advertised

TV commercials

Similar commercials