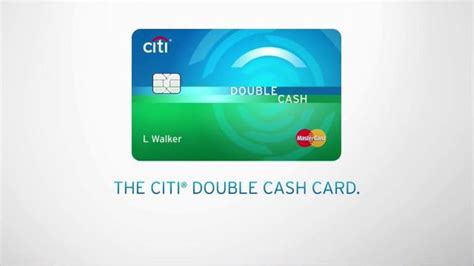

What is Citi (Credit Card) Double Cash?

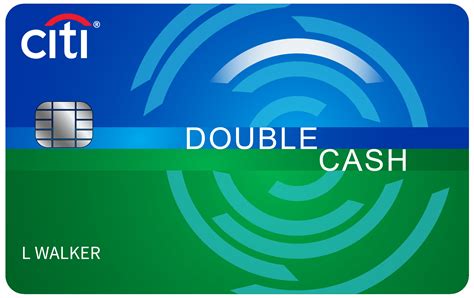

Citi Double Cash Card is a credit card that offers cash back rewards to its users. The card has two cashback opportunities where you can first earn 1% cashback on your purchases, then earn an additional 1% cashback as you pay. That makes a total of 2% earning per dollar spent with your Citi double cash card.

The cashback rewards are unlimited regardless of the purchase category, whether you shop for groceries, gas, dining, or anything else. Plus, there's no limit to how much cashback you can earn with the Citi Double Cash Card. This feature is perfect for anyone looking to maximize their rewards without having to worry about earning caps.

Another feature that makes the Citi Double Cash Card stand out is the 0% APR on balance transfers for the first 18 months. That means you can transfer your high-interest balances from other credit cards to your Citi Double Cash Card and make payments towards it interest-free.

Another added perk of the card is that there are no annual fees charged, making it a cost-efficient choice for those who want to earn rewards without an annual cost.

Lastly, the Citi Double Cash Card offers a variety of features to help cardholders manage their spending and finances. The card provides account alerts, spending summaries, and online dispute resolutions. Cardmembers also have access to Citi's 24/7 customer service for any inquiries or concerns.

Overall, the Citi Double Cash Card is an excellent cashback credit card that provides flexibility, unlimited rewards, and appealing benefits without any annual fees.

Frequently Asked Questions about citi (credit card) double cash

Earn cash back rewards in every purchase with the Citi Double Cash ® Card. You earn unlimited 1% cash back on purchases made with your cash back credit card, plus another 1% cash back as you pay for those purchases, whether you pay in full or over time.

Flexibility. Even though the Citi® Double Cash Card is considered a cash-back credit card, technically what you're earning are Citi ThankYou points.

Unlike many balance transfer cards - and competing rewards cards - the Citi Double Cash doesn't offer an intro APR on purchases. If paying off debt is your goal, you should avoid saddling the card with too many purchases while paying off your transferred balance.

Here's the average credit limit of members who matched their Citi® Double Cash Card or similar cards. The average credit limit for members who have matched with this card or similar cards is $5,285, with $500 being the most common.

Your Citi® Double Cash Card – 18 month BT offer credit limit may increase automatically after six to 12 months if you consistently pay on time. You can also request a credit limit increase yourself by calling Citi or through its website.

For simple cash back, the Citi® Double Cash Card is among the best cards to consider. But you could probably wring more cash-back dollars from the Chase Freedom Unlimited®, especially if you dine out a lot and can use its other bonus categories.

No, it's not hard to get the Citi® Double Cash Card – 18 month BT offer. In fact, it's one of the easier top credit cards to open. You can qualify for it with fair credit (a FICO® Score of 580 to 669). Most of the best credit cards require good to excellent credit.

The Citi Double Cash Card credit limit is $500, at a minimum. Citi doesn't disclose an official maximum, but some cardholders report limits as high as $11,000. Just note that your actual credit limit will depend on your credit standing and income.

On our list, the card with the highest reported limit is the Chase Sapphire Preferred® Card, which some say offers a $100,000 limit. We've also seen an advertised maximum credit limit of $100,000 on the First Tech Odyssey Rewards™ World Elite Mastercard®, a credit union rewards card.

The highest credit limit for the Citi Diamond Preferred card can be over $10,000 for most creditworthy borrowers, according to multiple reports from cardholders on online forums. Citibank does not typically disclose the maximum spending limit for any of its unsecured credit cards.

The Capital One Quicksilver Cash Rewards Credit Card can offer some valuable perks in the beginning, but the better option with long-lasting value is the Citi® Double Cash Card. You can use it get out of debt or snag a decent rate on all purchases.

Our Verdict. With the ability to earn 2% cash back on all purchases - 1% when purchases are made and another 1% when they're paid off, the Citi® Double Cash Card, from our partner Citi, is a solid option for those who make their minimum payments on time.

The Citi® Double Cash Card has an advantage for balance transfers and overall cash back rate. You'll do much better with this card if the long balance transfer is worth it for you, and if most of your spending is outside of the Chase Freedom Unlimited®'s bonus categories.

There is no disclosed maximum credit limit for the Citi® Double Cash Card – 18 month BT offer. Cardholders have reported credit limits of $50,000 online, but Citi hasn't provided an official maximum. Your credit limit depends largely on your income and credit score.

It's really hard to pinpoint what credit limit you'll be granted with a credit score of 700. But since it's good credit, you maybe able to get as high as a $5,000 limit. A credit score of 750+, which is excellent credit, should put you in the $10,000 limit zone. But that's not a given.

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.