What the NetSpend Prepaid Mastercard Card TV commercial - Live Paycheck to Paycheck is about.

The NetSpend Prepaid Mastercard Card TV Spot, titled 'Live Paycheck to Paycheck', offers an insightful glimpse into the challenges of managing finances when living paycheck to paycheck. The spot opens with a young woman attempting to stretch her paycheck by making ends meet at the end of the month. She's seen turning off lights, trying to conserve electricity, but still struggling to make ends meet.

As the video progresses, the woman is seen struggling with the pressure of bills and expenses piling up, and the constant fear of having inadequate funds to make ends meet. The woman is also seen getting turned down by traditional credit cards and financial services.

In the next scene, the ad introduces NetSpend Prepaid Mastercard Card as the perfect solution for people who find themselves in a similar situation. The ad emphasizes the benefits of using the card, like getting paid up to 2 days faster, avoiding overdraft fees, and the ability to shop online and in stores securely.

Overall, the NetSpend Prepaid Mastercard Card TV spot strikes a chord with its poignant message of financial empowerment. By offering a viable solution for individuals who struggle to manage their finances, the ad helps viewers see the NetSpend card as a tool that can help them take control of their financial well-being.

NetSpend Prepaid Mastercard Card TV commercial - Live Paycheck to Paycheck produced for

NetSpend Card

was first shown on television on October 19, 2022.

Frequently Asked Questions about netspend prepaid mastercard card tv spot, 'live paycheck to paycheck'

Netspend is a company with prepaid cards that offers an alternative to checking account debit cards, credit cards, and cash. Customers provide the company with their names and addresses, and the company mails them personalized cards that they activate and load with funds. The cards are operated by Mastercard and Visa.

Rêv Worldwide, Inc.Searchlight Capital

Netspend Corporation/Parent organizations

AUSTIN, May 1, 2023 - International payments company Rêv Worldwide (Rêv), in partnership with funds advised by Searchlight Capital Partners, L.P. (Searchlight), today completed its purchase of the Netspend consumer business from Global Payments (NYSE: GPN) in an all-cash transaction valued at $1 billion.

NetSpend's detractors point to several drawbacks, especially when compared to traditional checking accounts. For the most part, this comes down to the number of fees. To some, NetSpend takes too many small bites out of an account balance to be worth the convenience.

The card serves as an alternative to traditional banking while providing many of the same services you may find at a local or online bank. As a financial technology company, Netspend isn't a bank, but it partners with banks to provide banking services attached to its prepaid cards.

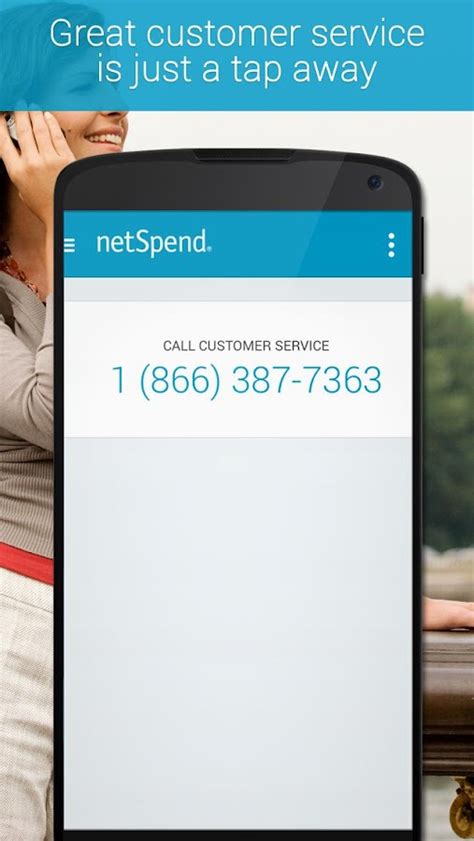

Using Netspend card overseas

Netspend cards can be used worldwide and prepaid cards have always been a smarter choice if you are willing to travel abroad. Prepaid debit cards are safer as well. If your card is stolen, lost, or compromised, you can call customer service immediately and get it deactivated.

It's a bank account built with you mind. There's no credit check and no minimum balance required to open an account. * Best of all, you get access to online banking, paydays up to 2 days earlier[1] with Direct Deposit, optional high-yield Savings Account[2] and many more features.

It's a bank account built with you mind. There's no credit check and no minimum balance required to open an account. * Best of all, you get access to online banking, paydays up to 2 days earlier[1] with Direct Deposit, optional high-yield Savings Account[2] and many more features.

Netspend is a registered agent of The Bancorp Bank, Pathward, NA, and Republic Bank & Trust Company.

Netspend allows individuals to receive access to their direct deposit funds two days early, and your money is FDIC-insured via Netspend's relationship with three banks. The company does not charge overdraft fees and allows consumers to open a savings account that pays 5% on balances of less than $1,000.

Netspend is a financial technology company. Banking services are provided by our bank partners.

Is Netspend a Real Debit Card? It's a real debit card in the sense that it can be used just like a debit card. What many people traditionally think of as a debit card is tied to a bank account that must be funded for the debit card to be useful. Netspend cards also must be funded for use.

Netspend cards can be used internationally and are accepted at any location that accepts a debit Visa or Mastercard, depending on the card's brand. Netspend is a TSYS company and a registered agent of Axos bank. It serves over 10 million customers and offers more than 130,000 reload locations in America.