What the NetSpend Card WWE Prepaid Mastercard TV commercial - My Big E is about.

The NetSpend Card WWE Prepaid Mastercard recently released a new TV ad called "My Big E," which features WWE superstars Bianca Belair and Big E. The ad opens with Belair standing outside of a food truck getting ready to make a purchase at the register. As she starts totaling up her order, Big E suddenly pops up beside her and starts rapping in his signature style about the benefits of using NetSpend Card.

Big E boasts about how NetSpend saves him time and money, and encourages Belair to ditch her cash and upgrade to the card. And just like that, Belair decides to give it a try! We then see her using her NetSpend card to buy items at various places around the city. Throughout the ad, Big E and Belair bust out into some fun dance moves and provide plenty of entertaining moments for viewers.

Overall, the ad perfectly showcases the benefits of using NetSpend card, as well as the fun, playful side of two popular WWE superstars. The combination of music, humor, and slick editing work together to make it a memorable and engaging commercial. Whether you're a wrestling fan or not, "My Big E" is a must-see TV spot that you won't soon forget!

NetSpend Card WWE Prepaid Mastercard TV commercial - My Big E produced for

NetSpend Card

was first shown on television on November 27, 2022.

Frequently Asked Questions about netspend card wwe prepaid mastercard tv spot, 'my big e' featuring bianca belair and big e

Is Netspend a Real Debit Card? It's a real debit card in the sense that it can be used just like a debit card. What many people traditionally think of as a debit card is tied to a bank account that must be funded for the debit card to be useful. Netspend cards also must be funded for use.

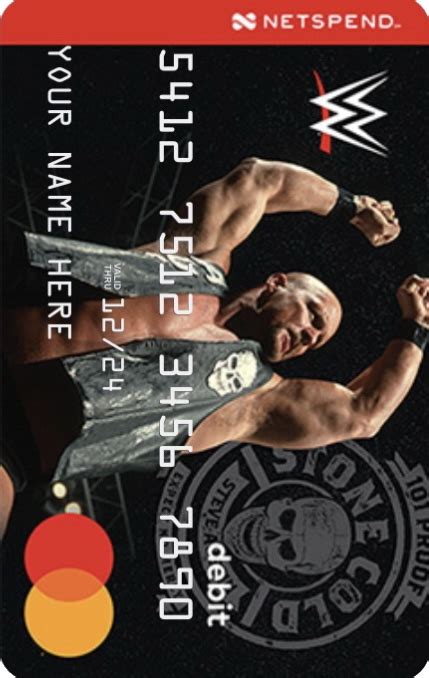

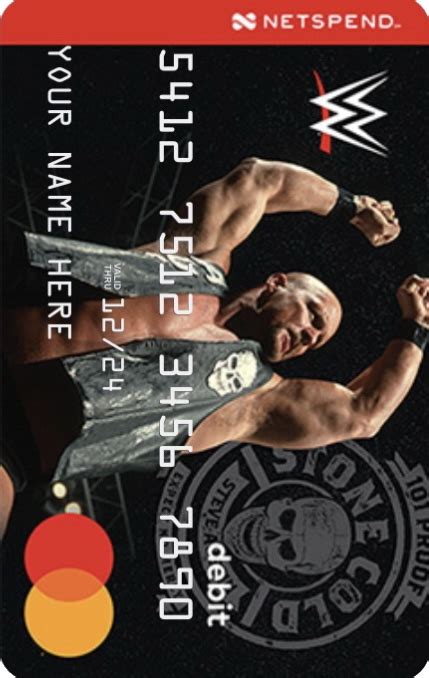

Netspend is a company with prepaid cards that offers an alternative to checking account debit cards, credit cards, and cash. Customers provide the company with their names and addresses, and the company mails them personalized cards that they activate and load with funds. The cards are operated by Mastercard and Visa.

With a Netspend® Visa® Prepaid Card and Netspend® Prepaid Mastercard® you choose the options that fit your life best, giving you the freedom and control to do your banking your way. Your life's not like everyone else's, so why should your money be? Card usage is subject to card activation and identity verification.

Call Netspend

Another way to check your balance is to call Netspend's toll-free number at 1-866-387-7363.

Netspend is a financial technology company. Banking services are provided by our bank partners.

The Bottom Line. Netspend offers prepaid debit cards with Mastercard or Visa branding. Cards can be funded in ways that are similar to how one might manage an online bank account.

Netspend allows individuals to receive access to their direct deposit funds two days early, and your money is FDIC-insured via Netspend's relationship with three banks. The company does not charge overdraft fees and allows consumers to open a savings account that pays 5% on balances of less than $1,000.

Did the IRS send prepaid debit cards? Yes. The prepaid debit cards are known as the Economic Impact Payment Card, and were prepared by the Bureau of the Fiscal Service, part of the Treasury Department. Check your mail carefully.

Netspend allows individuals to receive access to their direct deposit funds two days early, and your money is FDIC-insured via Netspend's relationship with three banks. The company does not charge overdraft fees and allows consumers to open a savings account that pays 5% on balances of less than $1,000.

You can check your balance by logging in online or on a mobile app, calling the number on the back of the card or by checking their paper statement. It's important to know your balance to avoid hitting credit limits and to prevent overspending in general.

Start by looking at the back of your gift card. Typically, you'll find a toll-free number you can call to discover your balance. Or you can check your balance by visiting the card issuer's site and entering your card's 16-digit number and security code.

"Depending on how many checks a consumer cashes each month, choosing a Netspend account could be more cost-effective and allow individuals to shop online, use ATMs and send money to friends," she says. The company sends people cards after they sign up online, or you can buy them from retail locations for a fee.