AAG Reverse Mortgage TV commercial - Homework

Advertisers

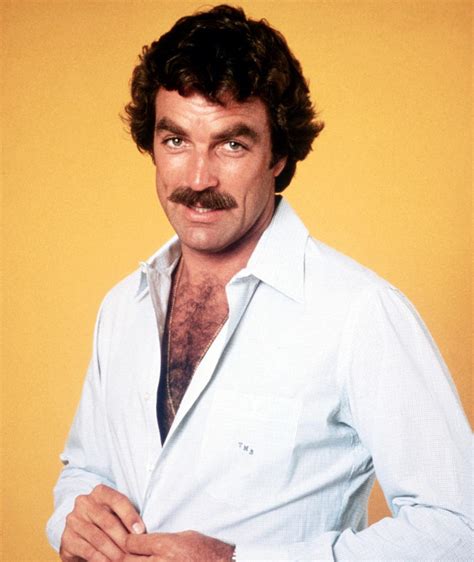

Advertisers of the AAG Reverse Mortgage TV Spot, 'Homework' Featuring Tom Selleck

American Advisors Group (AAG)

American Advisors Group (AAG) is a company that specializes in providing reverse mortgage loans and other home equity retirement solutions. With a focus on helping seniors build a more financially sec...

What the AAG Reverse Mortgage TV commercial - Homework is about.

The AAG Reverse Mortgage TV spot titled 'Homework' features Hollywood icon Tom Selleck as he talks about equity release for seniors. In the ad, Tom Selleck explains how a reverse mortgage can provide seniors with financial stability and future planning by allowing them to access the equity in their homes.

Selleck emphasizes the importance of doing one's homework before choosing a reverse mortgage provider and encourages viewers to consider AAG (American Advisors Group), offering expert advice and guidance on reverse mortgages.

The ad highlights how a reverse mortgage can help seniors pay off debt, fund home improvements, or simply afford a more comfortable lifestyle in retirement. Tom Selleck's trusted presence in the ad provides a sense of calm and reassurance to seniors who may be anxious about their finances in their golden years.

Overall, the AAG Reverse Mortgage TV spot does an excellent job of explaining the benefits of a reverse mortgage while reassuring seniors that they can trust AAG as a provider. It's a persuasive ad that encourages viewers to consider their future plans and to take advantage of the equity they have worked hard to build in their homes.

AAG Reverse Mortgage TV commercial - Homework produced for American Advisors Group (AAG) was first shown on television on August 2, 2016.

Frequently Asked Questions about aag reverse mortgage tv spot, 'homework' featuring tom selleck

Videos

Watch AAG Reverse Mortgage TV Commercial, 'Homework'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in AAG Reverse Mortgage TV Spot, 'Homework' Featuring Tom Selleck

Products

Products Advertised

TV commercials

Similar commercials