Root Insurance TV commercial - Customize Your Coverage

Advertisers

Advertisers of the Root Insurance TV Spot, 'Customize Your Coverage'

Root Insurance

Root Insurance is an innovative company that is revolutionizing the car insurance industry. With a fresh approach to coverage, Root Insurance is disrupting the traditional insurance model by providing...

What the Root Insurance TV commercial - Customize Your Coverage is about.

Root Insurance company is a digital auto insurance provider that offers a personalized policy based on individual driving habits. Root's latest TV spot, "Customize Your Coverage," emphasizes the company's focus on providing tailored insurance coverage to its customer base.

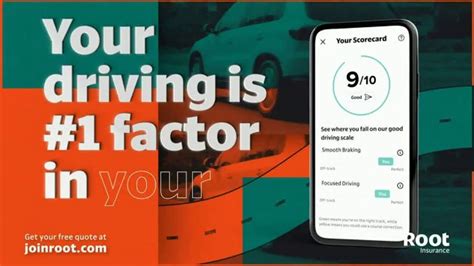

The commercial begins with a young woman driving her car down a busy city street while a robotic voice narrates the details of her driving habits. The narrator explains that Root uses an advanced algorithm that takes into account all sorts of factors when determining the cost of a policy, including how frequently the driver slams on the breaks and how quickly they accelerate.

The commercial then reveals the woman's customized insurance plan, which is based on her unique driving habits. It includes a $45 monthly payment and offers coverage for things like theft, damage, and liability, all tailored to her specific needs.

The overall message of the commercial is that Root Insurance offers an innovative approach to auto insurance. Rather than using generic pricing models to determine a driver's premium, the company takes a more individualized approach. This makes it possible for drivers to save money on a policy while still maintaining the coverage they need.

Root Insurance's "Customize Your Coverage" TV spot emphasizes the company's commitment to providing exceptional coverage tailored to individual drivers. It provides a fresh perspective on the often-overwhelming world of auto insurance and positions Root as a tech-savvy and innovative player in the industry.

Root Insurance TV commercial - Customize Your Coverage produced for Root Insurance was first shown on television on August 9, 2021.

Frequently Asked Questions about root insurance tv spot, 'customize your coverage'

Videos

Watch Root Insurance TV Commercial, 'Customize Your Coverage'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in Root Insurance TV Spot, 'Customize Your Coverage'

Products

Products Advertised

TV commercials

Similar commercials