PNC Bank Virtual Wallet TV commercial - Control Freak

Advertisers

Advertisers of the PNC Bank Virtual Wallet TV Spot, 'Control Freak'

PNC Financial Services

The PNC Financial Services Group , Inc. (PNC) is a diversified financial services company based in the United States. It provides a wide range of financial products and services to individuals, corpor...

What the PNC Bank Virtual Wallet TV commercial - Control Freak is about.

The PNC Bank Virtual Wallet TV spot entitled 'Control Freak' is a humorous and relatable depiction of the stress and anxiety that comes with managing one's finances. The commercial features a man who is a self-proclaimed control freak, who is shown meticulously measuring and balancing everything in his life, from his coffee to his workouts.

However, when it comes to his finances, he is unable to find the same level of control and organization. The commercial shows him frantically searching through paper bills and receipts, clearly overwhelmed by the task at hand.

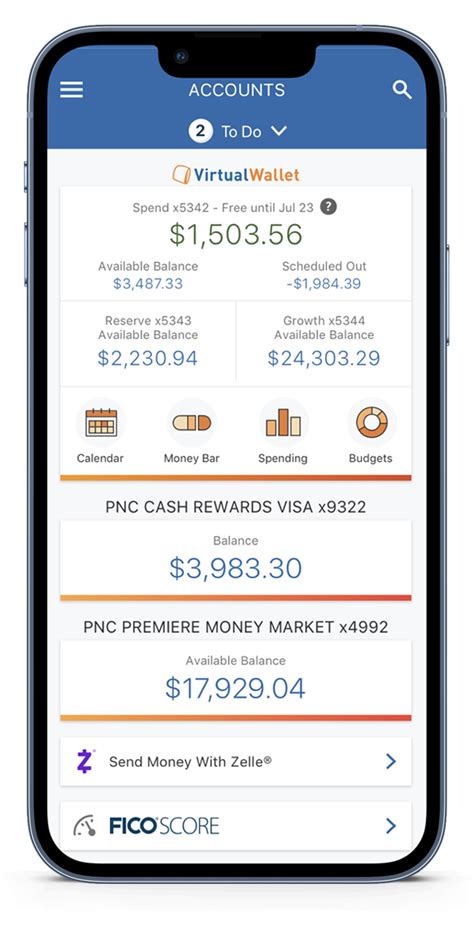

Enter the PNC Bank Virtual Wallet, a digital tool that allows users to manage their finances with ease. The commercial shows how the man is able to regain control with the help of the Virtual Wallet, utilizing its features to organize his bills, track his spending, and even set up automatic payments, all from his smartphone.

The commercial's message is clear: managing your finances doesn't have to be stressful and overwhelming. With the help of PNC Bank's Virtual Wallet, users can take control of their finances and feel confident in their ability to manage their money effectively.

Overall, the PNC Bank Virtual Wallet TV spot entitled 'Control Freak' provides a humorous yet relatable take on the challenges of managing finances, while also highlighting the benefits and ease of using PNC Bank's Virtual Wallet to regain control and manage one's finances with ease.

PNC Bank Virtual Wallet TV commercial - Control Freak produced for PNC Financial Services was first shown on television on July 11, 2012.

Frequently Asked Questions about pnc bank virtual wallet tv spot, 'control freak'

Videos

Watch PNC Bank Virtual Wallet TV Commercial, 'Control Freak'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in PNC Bank Virtual Wallet TV Spot, 'Control Freak'

Agenices

Agenices of the PNC Bank Virtual Wallet TV Spot, 'Control Freak'

Deutsch

I'm happy to help you write about a company Deutsch. Can you please provide me with more information about what you would like me to include in my response? This will help me provide you with the most...

Products

Products Advertised

TV commercials

Similar commercials