Ally Bank TV commercial - Equal Investment in Womens Sports Media

Advertisers

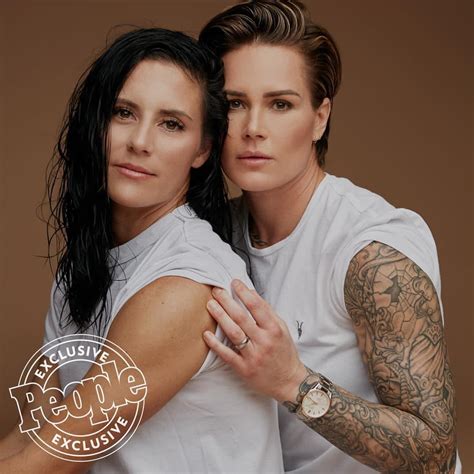

Advertisers of the Ally Bank TV Spot, 'Equal Investment in Women's Sports Media' Featuring Ali Krieger, Ashlyn Harris

What the Ally Bank TV commercial - Equal Investment in Womens Sports Media is about.

The Ally Bank TV Spot titled 'Equal Investment in Women's Sports Media' is a powerful commercial that features two of the most celebrated female soccer players in the United States - Ali Krieger and Ashlyn Harris. The commercial highlights the inequality between men's and women's sports media, where women's sports receive significantly less coverage than men's sports.

The TV spot starts with Ali Krieger receiving a notification on her phone about the live-streaming of a men's soccer game on TV. Despite being a professional soccer player herself, she is disappointed that women's sports don't receive the same level of coverage as men's sports. Ashlyn Harris joins her and expresses her frustration with the lack of resources and investments in women's sports. The two athletes then team up with Ally Bank to inspire change in the sports industry.

The duo makes a compelling plea for equal opportunity and investment in women's sports media. They urge fans, media outlets, sponsors, and investors to recognize and support female athletes. The TV spot makes a bold and clear statement about the importance of equality in women's sports and highlights the need for more investment in women's sports media.

The commercial ends with a bold message from Ally Bank, "Don't stand for inequality in sports. Ally will match every dollar spent on the Women's World Cup up to $500,000." This campaign has been well-received by fans across the globe, as it speaks to the need for creating a more just and equal society for everyone, especially women in sports. Overall, the Ally Bank TV Spot is an excellent commercial that spotlights the need for equal investment and opportunities in women's sports media.

Ally Bank TV commercial - Equal Investment in Womens Sports Media produced for Ally Bank was first shown on television on May 25, 2023.

Frequently Asked Questions about ally bank tv spot, 'equal investment in women's sports media' featuring ali krieger, ashlyn harris

Videos

Watch Ally Bank TV Commercial, 'Equal Investment in Women's Sports Media'

Unfortunately we were unable to find any suitable videos in the public domain. Perhaps the video of this TV commercial has not been preserved. If you know the link to this commercial, you can send it to us using a special form.

Actors

Actors who starred in Ally Bank TV Spot, 'Equal Investment in Women's Sports Media' Featuring Ali Krieger, Ashlyn Harris

Agenices

Agenices of the Ally Bank TV Spot, 'Equal Investment in Women's Sports Media' Featuring Ali Krieger, Ashlyn Harris

Anomaly

Anomaly is a global creative agency that was founded in 2004 by Carl Johnson, Jason DeLand, and Richard Mulder. With offices in New York, Los Angeles, London, Amsterdam, Berlin, and Shanghai, the agen...

TV commercials

Similar commercials