What the Self Financial Inc. TV commercial - Struggling is about.

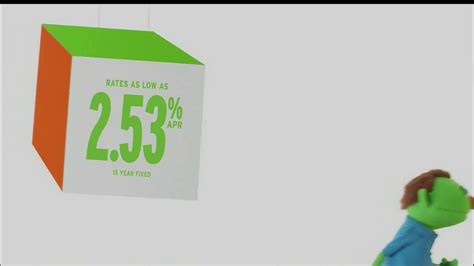

Self Financial Inc. is a company that offers credit-building services to help individuals achieve financial freedom. The company recently launched a TV spot called 'Struggling,' which highlights the challenges many people face when trying to improve their credit score.

The TV spot begins with a scene of a man struggling to open a bank account due to poor credit. The man then shares his disappointment with his wife, who encourages him to take control of his finances. The next scene showcases the man using Self Financial Inc.'s services to improve his credit score.

Throughout the TV spot, viewers can see the positive impact that Self Financial Inc.'s credit-building services have on the man's financial life. It emphasizes how Self Financial Inc. can help individuals get back on track and achieve financial freedom.

The message of the TV spot is clear - financial struggles can be overwhelming, but with the right support, it is possible to overcome them. The 'Struggling' TV spot encourages individuals to take control of their finances and shows how Self Financial Inc. can be a valuable partner on that journey.

Overall, the 'Struggling' TV spot is a powerful and inspiring advertisement that reminds us that, with the right support, we can overcome financial struggles and achieve our financial goals.

Self Financial Inc. TV commercial - Struggling produced for

Self Financial Inc.

was first shown on television on May 17, 2021.

Frequently Asked Questions about self financial inc. tv spot, 'struggling'

More than 100 million Americans have a low or no credit score. These Americans are either locked out of the traditional finance system or pay higher fees and interest rates for access to credit. Additionally, they often pay more for insurance and other services.

Walter Cavanagh

Still, you've probably never heard anyone advocate for having quite as many credit cards as Walter Cavanagh. Cavanagh was recently recognized by Guinness World Records as having the most open, active credit card accounts in the world.

But your credit score won't start at zero, because there's no such thing as a zero credit score. The lowest score you can have is a 300, but if you make responsible financial decisions from the beginning, your starting credit score is more likely to be between 500 and 700.

Lenders use such a wide variety of credit scores (and versions of scores) that no single score is definitively the most important. The FICO® Score is used by 90% of top lenders, but there are at least 16 versions of that model in use.

Percent of people aged 15+ who have a credit card, 2021 - Country rankings:

| Countries | Percent people with credit cards, 2021 | Global rank |

|---|

| Canada | 82.74 | 1 |

| Israel | 79.05 | 2 |

| Iceland | 74 | 3 |

| Hong Kong | 71.63 | 4 |

Tier 2 Credit: Considered a very good credit score, scores ranging from 740 – 799. Tier 3 Credit: Considered good credit with scores typically ranging from 670 – 739. Tier 4 Credit: Considered fair or poor credit, with scores that can range from 580 – 300.

Generally, credit scores range from 300 to 850, making 300 the lowest possible credit score. But it's important to note that you typically have more than one credit score. And they may differ depending on the credit-scoring company and when they were calculated.

Here are some of the major benefits of building credit.

- Better approval rates. If you have a good credit score, you're more likely to be approved for credit products, like a credit card or loan.

- Lower interest rates. The higher your credit score, the lower interest rates you'll qualify for.

- Better terms.

- Robust benefits.

Five things that make up your credit score

- Payment history – 35 percent of your FICO score.

- The amount you owe – 30 percent of your credit score.

- Length of your credit history – 15 percent of your credit score.

- Mix of credit in use – 10 percent of your credit score.

- New credit – 10 percent of your FICO score.

850

Generally speaking, the highest credit score possible is 850, according to the most common FICO and VantageScore credit models. There are several factors that go into determining a credit score, such as payment history, amounts owed, length of credit history, credit inquiries and credit mix.

Japan. In Japan, there's no formal nationwide credit system. A person's creditworthiness is typically determined by each bank, based on its relationship with the consumer. Each financial institution will look at factors like salary, length of employment and current debts to determine their level of risk as a borrower.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 400 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.