Marcus by Goldman Sachs TV commercial - Personal Loans With No Fees. Ever.

Advertisers

Advertisers of the Marcus by Goldman Sachs TV Spot, 'Personal Loans With No Fees. Ever.' Featuring Rosamund Pike

Marcus by Goldman Sachs

Marcus by Goldman Sachs is a renowned financial institution that has made a significant impact on the banking and lending industry. Established in 2016, this digital banking platform has revolutionize...

What the Marcus by Goldman Sachs TV commercial - Personal Loans With No Fees. Ever. is about.

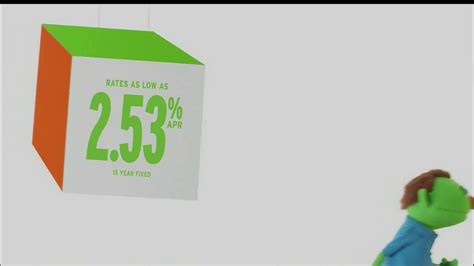

The Marcus by Goldman Sachs TV spot is all about personal loans with no fees – ever. The ad features Rosamund Pike, the star of movies like “Gone Girl” and “Die Another Day”. Pike is shown strolling through a house with a calm, soothing voiceover encouraging viewers to take control of their finances and consolidating their debt with a personal loan from Marcus by Goldman Sachs.

The concept behind the ad is simple and straight forward. Marcus by Goldman Sachs is a company offering personal loans with no fees attached, and they wanted to get the message out there to as many people as possible. The message is that with a little financial help from Marcus, people can take control of their finances and free themselves from the burden of high-interest credit card debt.

The ad also emphasizes the simplicity of Marcus’s personal loan application process. It shows that in just a few steps, customers can apply for a loan and get approved quickly. This emphasis on simplicity and transparency is something that Marcus by Goldman Sachs prides itself on, and the ad does a great job of showcasing these values to potential customers.

Overall, the Marcus by Goldman Sachs TV Spot featuring Rosamund Pike is an excellent example of an effective financial services ad. It’s clear, concise, and to the point, all while being gracefully delivered by Pike. The message of no fees is a compelling one, and Marcus has done a great job of getting that message across in an engaging and memorable way.

Marcus by Goldman Sachs TV commercial - Personal Loans With No Fees. Ever. produced for Marcus by Goldman Sachs was first shown on television on July 11, 2021.

Frequently Asked Questions about marcus by goldman sachs tv spot, 'personal loans with no fees. ever.' featuring rosamund pike

Videos

Watch Marcus by Goldman Sachs TV Commercial, 'Personal Loans With No Fees. Ever.'

Unfortunately we were unable to find any suitable videos in the public domain. Perhaps the video of this TV commercial has not been preserved. If you know the link to this commercial, you can send it to us using a special form.

Actors

Actors who starred in Marcus by Goldman Sachs TV Spot, 'Personal Loans With No Fees. Ever.' Featuring Rosamund Pike

Agenices

Agenices of the Marcus by Goldman Sachs TV Spot, 'Personal Loans With No Fees. Ever.' Featuring Rosamund Pike

Huge

Huge is a creative growth acceleration that was founded in 1999 in Dumbo ), Brooklyn. It operates as a creative consultancy and works with ambitious brands to help them grow by increasing the creative...

Products

Products Advertised

TV commercials

Similar commercials