Consolidated Credit Counseling Services TV commercial - Get Rid of Those Debt Suckers

Advertisers

Advertisers of the Consolidated Credit Counseling Services TV Spot, 'Get Rid of Those Debt Suckers'

Consolidated Credit Counseling Services

Consolidated Credit Counseling Services is a non-profit organization that aims to help people manage their finances and get out of debt. The company was founded in 1993 and has since helped thousands...

What the Consolidated Credit Counseling Services TV commercial - Get Rid of Those Debt Suckers is about.

Consolidated Credit Counseling Services is a nonprofit organization that helps people struggling with debt. The organization recently created a TV spot titled 'Get Rid of Those Debt Suckers' that aims to motivate viewers to take control of their finances.

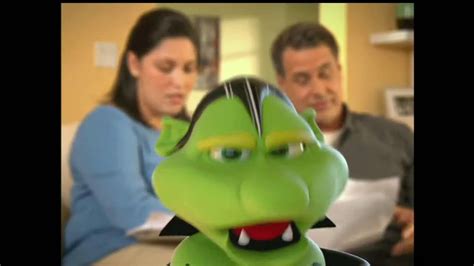

The spot features people dressed in leech costumes representing the various forms of debt that can suck the life out of one's finances. The leeches cling to people and follow them around, representing the constant burden of debt.

The ad takes a lighthearted approach to a serious topic, using humor to engage viewers while still conveying the importance of getting rid of debt. The leeches are visually engaging and help to create a memorable image that viewers are likely to remember.

The ad then goes on to promote Consolidated Credit Counseling Services as a solution for those struggling with debt. The organization provides free credit counseling, debt management plans, and financial education to help people get back on track with their finances and rid themselves of the debt suckers.

Overall, the 'Get Rid of Those Debt Suckers' TV spot is a creative and effective way to promote Consolidated Credit Counseling Services. It highlights the organization's mission while also engaging viewers and making them more aware of the importance of managing their debt.

Consolidated Credit Counseling Services TV commercial - Get Rid of Those Debt Suckers produced for Consolidated Credit Counseling Services was first shown on television on February 4, 2020.

Frequently Asked Questions about consolidated credit counseling services tv spot, 'get rid of those debt suckers'

Videos

Watch Consolidated Credit Counseling Services TV Commercial, 'Get Rid of Those Debt Suckers'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Agenices

Agenices of the Consolidated Credit Counseling Services TV Spot, 'Get Rid of Those Debt Suckers'

Zimmerman Advertising

Zimmerman Advertising is a full-service advertising agency that is located in Fort Lauderdale, Florida. The company was founded in 1984 by Jordan Zimmerman and has grown to become one of the largest a...

TV commercials

Similar commercials