What the PetSmart TV commercial - Holiday Donations is about.

PetSmart TV Spot, 'Holiday Donations' is a poignant advertisement that focuses on the importance of giving back to the community during the holiday season. The ad begins with a montage of adorable pets eagerly awaiting their turn to be adopted. Bright and cheerful music plays in the background, setting the mood for the festive season.

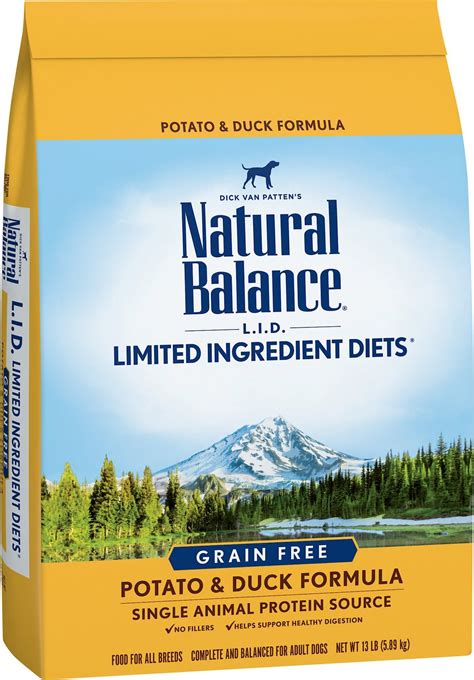

The voiceover then invites viewers to make a difference in the lives of these pets by donating to PetSmart's holiday donation drive. Viewers are encouraged to visit a PetSmart store near them and take part in the 'Buy a Bag, Give a Meal' program, where for every bag of pet food purchased, PetSmart will donate a meal to a pet in need.

The ad highlights the impact of even the smallest donation on the lives of these pets. It showcases the joy on the faces of the shelter staff and the wagging tails of the pets as they receive the donated food and supplies. The ad ends with the message that during the holiday season, everyone can make a difference by spreading love and joy to those who need it the most, including these furry friends.

Overall, the PetSmart TV Spot, 'Holiday Donations' is a heartwarming reminder of the power of giving back and the impact it can have on those who need it the most. It encourages viewers to take action and make a positive difference in the world, even if it's just one meal at a time.

PetSmart TV commercial - Holiday Donations produced for

PetSmart

was first shown on television on October 29, 2017.

Frequently Asked Questions about petsmart tv spot, 'holiday donations'

PetSmart Charities is a 501(c)3 tax-exempt organization and your donation is tax-deductible within the guidelines of U.S. law. To claim a donation as a deduction on your U.S. taxes, please keep your email donation receipt as your official record. We'll send it to you upon successful completion of your donation.

PetSmart Charities efficiently uses more than 90 cents of every dollar donated to fulfill its role as the leading funder of animal welfare in North America, granting almost $400 million since its inception in 1994.

20% to 60%

How much can you donate to charity for a tax deduction? Generally, itemizers can deduct 20% to 60% of their adjusted gross income for charitable donations. The exact percentage depends on the type of qualified contribution as well as the charity or organization.

Our current top-rated charities and nonprofit organisations

| Charity | Cause area | Donate |

|---|

| Good Food Institute | Improving animal welfare | Donate |

| The Humane League | Improving animal welfare | Donate |

| Wild Animal Initiative | Improving animal welfare | Donate |

| Johns Hopkins Center For Health Security | Creating a better future | Donate |

They can help save pets' lives

Because there are so many homeless pets, donors are happy to see that together, we save a lot of lives - more than 1,400 per day in the United States. Through our adoption centers and sponsored events, PetSmart Charities facilitates more than 550,000 adoptions every year.

Charitable giving can help those in need or support a worthy cause; it can also lower your income tax expense. Eligible donations of cash, as well as items, are tax deductible, but be sure that the recipient is a 503(c)(3) charitable organization and keep your donation receipts.

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

High-Rated and Low-Rated Charities

| High-Rated | Low-Rated |

|---|

| American Kidney Fund (Rockville, Md.) | Defeat Diabetes Foundation (Madeira Beach, Fla.) |

| Children's Health Fund(New York City) | Heart Center of America (Knoxville, Tenn.) |

| Lupus Research Alliance (New York City) | National Caregiving Foundation (Dunkirk, Md.) |

Our current top-rated charities and nonprofit organisations

| Charity | Cause area | Donate |

|---|

| Unlimit Health | Improving human wellbeing | Donate |

| Faunalytics | Improving animal welfare | Donate |

| Good Food Institute | Improving animal welfare | Donate |

| The Humane League | Improving animal welfare | Donate |

You can claim a deduction of up to 60% of your Adjusted Gross Income. If you donated household items that are in less than good used condition, if the total estimated value is more than $500, you may still take the deduction. However, you should include a qualified appraisal on your return.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

For cash donations under $250, you'll need either a bank record (like a canceled check or bank statement) or a written acknowledgment from the charity, which includes the date and amount of your contribution. Bank records are insufficient for cash donations of $250 or more.