What is Farmers Insurance Boat & Watercraft Insurance?

Farmers Insurance offers Boat & Watercraft Insurance to cover various types of watercraft, including boats, sailboats, yachts, jet skis, and personal watercraft. This insurance offers protection against damage, loss, and liability while operating a watercraft.

The coverage provided by Farmers Insurance for Boat & Watercraft Insurance includes physical damage coverage for the boat or watercraft, which covers the cost of repairing or replacing the boat or watercraft if it is damaged due to an accident, theft, or other covered incidents. Additionally, it covers damages to other people's property and injuries to other people if you are found to be at fault for the accident.

Farmers Insurance offers additional coverage options for Boat & Watercraft Insurance, such as roadside assistance, personal effects coverage, and coverage for fishing equipment. It also has various discounts for customers who have safety certifications or anti-theft devices installed on their watercraft.

To obtain Farmers Insurance Boat & Watercraft Insurance, customers can reach out to a local agent or go online to get a quote. By providing information about the watercraft, intended use, and estimated value, customers can get an accurate quote for the cost of insurance. With comprehensive coverage options and competitive pricing, Farmers Insurance Boat & Watercraft Insurance can offer peace of mind to those who love life on the water.

Frequently Asked Questions about farmers insurance boat & watercraft insurance

New York law doesn't require you to have boat insurance. But whether you own a boat or personal watercraft, a boat insurance policy can help protect it.

$300 to $500 annually

Boat insurance in British Columbia typically ranges from $300 to $500 annually, with costs influenced by multiple factors including boat type, value, motor type, and level of coverage.

How much is boat insurance? Expect to pay about 1.5% of your boat's value for personal watercraft insurance. For a $20,000 boat, expect to pay about $300 per year. Of course, this number will fluctuate based on the type of coverage and other factors.

Boat insurance isn't mandatory in Florida, meaning it's not required by law to own or operate a vessel. However, if you took out a loan using your boat as collateral, the lender will typically require that you have insurance to cover damages to the boat.

Marine insurance is especially important due to the high-risk nature of the industry and the unpredictability of the sea. Accidents happen all the time, and you never know when something may go wrong with the equipment or the weather during a voyage.

That being said, there are certain marinas, and most inland waterways that insist on boat owners to have at least some form of boat insurance. It's generally seen as good practice to provide boat insurance details if requested. It is recommended that you have at least third-party liability insurance.

Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination.

Liability insurance: Liability insurance financially protects boat owners if they cause third-party property damage or an injury. Risk coverage: Risk coverage protects policyholders from a variety of miscellaneous risks, like capsizing, collisions, fire damage, etc.

Collision coverage protects your watercraft from accidents involving other boaters and objects such as buoys and docks. Comprehensive coverage covers the cost to replace or repair your boat for events outside of your control, such as fire, theft, and vandalism.

Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination.

Marine insurance is an indispensable component of the maritime industry, serving as a catalyst for global trade, economic development, and industry resilience. It mitigates risks, protects assets, facilitates trade, and ensures prompt compensation for losses.

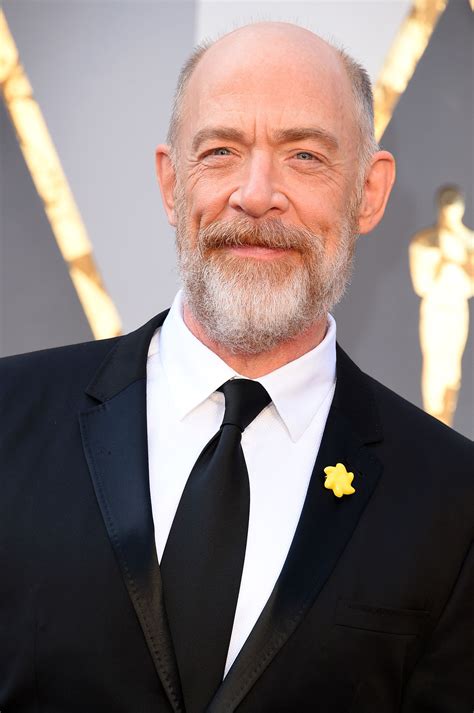

SHIP is a national program that offers one-on-one assistance, counseling, and education to Medicare beneficiaries, their families, and caregivers to help them make informed decisions about their care and benefits.

The Three Main Classifications Of Marine Insurance. The three most common types of marine insurance are hull, cargo, and protection and indemnity (P&I). There is no such thing as a standard marine insurance policy.

Marine Insurance Covers:

The primary objective of a marine insurance policy is to protect your finances and assets while they are being transported via sea. However, different insurance companies offer multiple types of marine insurance policies.

Marine insurance plays a vital role in the global economy, ensuring the protection of goods, vessels, and businesses involved in maritime trade, through various risk transfer mechanisms. The insurance of vessels and their cargo was one of the main factors responsible for the expansion of trade across the globe.

Marine insurance includes insurance against: liability arising out of bodily injury to, or the death of, a person, liability arising out of the loss of, or damage to, property, or. the loss of, or damage to, property.