What is StarMine Equity Summary Score?

IntroductionStarMine Equity Summary Score is a powerful stock research and monitoring tool created by Refinitiv , a provider of financial market data and infrastructure. It is an accuracy-weighted Thomson Reuters Starmine score that provides an insightful look into a company's potential future stock performance.

Components The Equity Summary Score is determined based on eight components, which analyze different aspects of a company's financial health. These components include analyst recommendations, earnings surprises, price momentum, valuation, earnings quality, and more. The overall score is a blend of each component score, and it ranges from 1 to 100, with 100 being the highest possible score.

UsageThe Equity Summary Score can be accessed through various trading platforms and brokerages, including Fidelity and E*Trade. It is a useful tool for both beginner and professional investors as it helps them to identify the stocks with potential growth and profitability. Investors can use this equity summary score as a quick reference point for the evaluation of a company's financial status.

Accuracy Refinitiv claims that the Equity Summary Score has a high correlation with future stock returns, indicating that it is an accurate predictor of stock performance. The accuracy of the Equity Summary Score is enhanced by the analyst recommendations and revisions model, which provides an insight into expert opinions.

ConclusionStarMine Equity Summary Score is a valuable tool for investors who are seeking to make informed investment decisions. It provides a quick and easy assessment of a company's financial health and predicts future stock performance with a high degree of accuracy. While it should not be used as the sole basis for making investment decisions, it could help investors to narrow down their choices and identify potentially profitable companies to invest in.

Frequently Asked Questions about starmine equity summary score

The StarMine Price Momentum ("Price Mo") model is a percentile (1-100) ranking of stocks based on recent historical price performance. Higher scores indicate stocks with the strongest price momentum. An overall score of 95 indicates that the security has better price momentum than roughly 95% of its peers.

Stocks get a grade of 1 to 5 for each criterion, 5 being the worst and 1 being the best score. The Overall score is based on the average score of all five criteria. Stocks must get an average score of 1.4 or below to be rated Very Attractive.

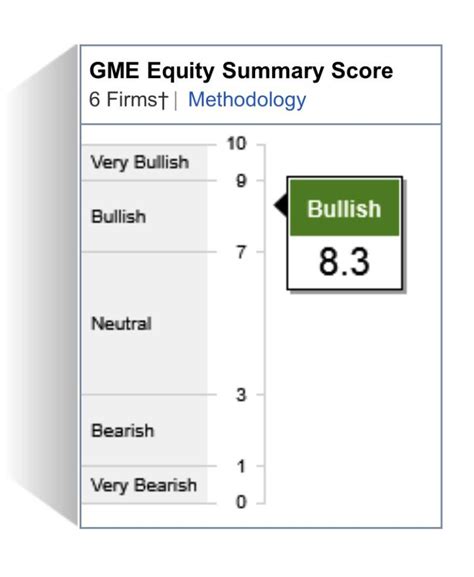

Being bearish in trading means you believe that a market, asset or financial instrument is going to experience a downward trajectory. Being bearish is the opposite of being bullish, which means that you think the market is heading upwards.

The Fidelity stock screener is a research tool provided to help self-directed investors evaluate these types of securities. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user.

Refinitiv's recent study shows that StarMine SmartEstimate is essentially as predictive today as it was 20 years ago. StarMine SmartEstimate remains the most accurate version of analyst consensus, and is predictive of the direction of future analyst revisions.

The star system rates funds on a scale from one to five stars. It ranks funds based on their past performance, with five stars meaning that a fund has historically posted the largest returns. These ratings are updated at the end of every month. The star system is a purely backward-looking.

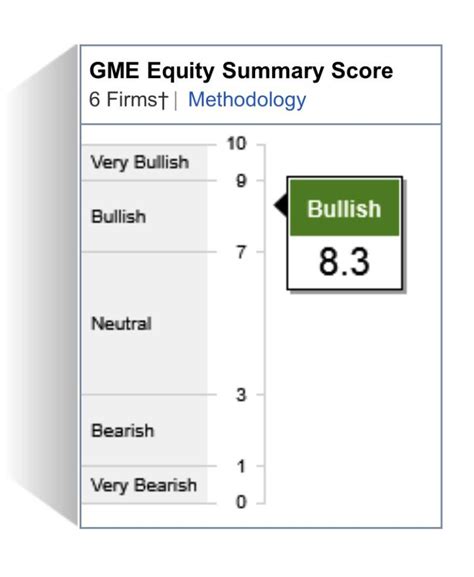

The Equity Summary Score is a consolidated accuracy weighted indication of independent research firms' sentiment for a given stock. It is calculated by StarMine, an independent third-party, using a proprietary model based on the daily opinions of independent research firms.

Stocks with a score of 8, 9, or 10 are considered Outperform. Stocks with a score of 4, 5, 6, or 7 are considered Neutral. Stocks with a score of 1, 2, or 3 are considered Underperform.

Growth stocks in bull markets tend to perform well, while value stocks are usually better buys in bear markets. Value stocks are generally less popular in bull markets based on the perception that, when the economy is growing, "undervalued" stocks must be cheap for a reason.

Avoid selling after the stocks have lost their value. An average bear market can last for a few months and it does not indicate a recession.

No problem! Try our research for FREE without opening an account. *Results from the ETF/ETP Screener include many types of Exchange-traded funds (ETFs) and Exchange-traded products (ETPs).

From our research, AltIndex is the most accurate stock predictor to consider today. Unlike other predictor services, AltIndex doesn't rely on manual research or analysis. On the contrary, AltIndex leverages the power of alternative data and artificial intelligence.

The Equity Summary Score is the output of a model whose inputs are the ratings of the independent research providers (IRPs). • A buy or sell rating. It is a calculated expression of the overall "sentiment" of the IRPs who have provided a rating on a stock.

VGSTX has a 5-year annualized total return of 6.83% and it sits in the top third among its category peers. But if you are looking for a shorter time frame, it is also worth looking at its 3-year annualized total return of 5.35%, which places it in the middle third during this time-frame.

Morningstar ratings evaluate funds, ranking how well they performed historically. A higher rating means that the fund has posted stronger returns than other, similar investments. If you're considering mutual funds or ETFs, Morningstar ratings may be useful to you.

Stocks with a score of 8, 9, or 10 are considered Outperform. Stocks with a score of 4, 5, 6, or 7 are considered Neutral. Stocks with a score of 1, 2, or 3 are considered Underperform.