What is JPMorgan Chase (Banking) Wealth Management?

JPMorgan Chase is a multinational banking and financial services company headquartered in New York City, with a focus on wealth management services. JPMorgan Chase offers personalized financial planning with its wealth management services, which includes options for investments, asset management, and advisory services.

JPMorgan Chase's wealth management services are offered through its Private Bank division, which provides customized investment management and advice to high-net-worth clients. The company's investment products may include bank-managed accounts and custody , as part of its wealth management services.

JPMorgan Chase also offers asset management services, which differ from its wealth management services in that they are geared more towards institutional clients, such as pension funds and endowments. Asset management services include investment strategies and portfolio management services.

Overall, JPMorgan Chase's wealth management services and offerings are designed to provide personalized financial solutions to clients, using a range of investment options and advisory services to help them achieve their financial goals.

Frequently Asked Questions about jpmorgan chase (banking) wealth management

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA, and SIPC. Insurance products are made available through Chase Insurance Agency, Inc.

Wealth management is a branch of financial services dealing with the investment needs of affluent clients. These are specialised advisory services catering to the investment management needs of affluent clients.

As stewards of the financial assets entrusted to us by our clients, we provide investment insights that take into consideration financially material factors impacting the value of our investments today and in the future, including sustainability risks.

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

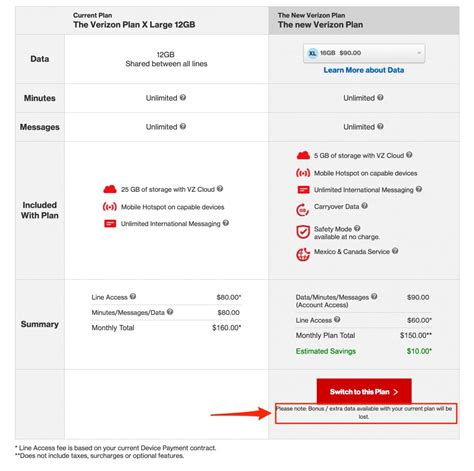

Customers can open an account with no startup fees and a $25,000 minimum initial investment. Annual management fees range from 0.6% for clients with $25,000 to $249,999, 0.5% for accounts with $250,000 to $1 million and 0.4% for accounts over $1 million.

He made a fortune in railroads. In 1898, Morgan formed the Federal Steel Company. Again he merged with other steel companies, forming the huge United States Steel Corporation.

Products

- Alternative Asset.

- Bonds, Corporate Fixed Deposits, Fixed Maturity Plan & Debentures.

- Loan's Retail & Corporate.

- Portfolio Management Services.

- Real Estate Services.

- Systematic Investment Plan.

- Online Investment.

- Fund Raising for Start-ups and others.

Example of wealth management

A few examples of wealth management include: Asset allocation: This strategy involves investing in a combination of different asset classes, such as stocks, bonds, and cash, to reduce the overall risk on your investment portfolio.

We invest for sustainable return in a sustainable world. Our goal is to create sustainable value for our clients. Our research-led approach is continually evolving to consider everything material to our clients' investments over the long term – including environmental, social and governance factors.

Wealth management is focused more on personal service of individuals, while investment banking clients are primarily corporations. There is frequently some overlap between the operations of investment bankers and wealth management firms.

JPMorgan Chase is one of the world's oldest, largest and best-known financial institutions. With a history that traces our roots to 1799 in New York City, we carry forth the innovative spirit of our heritage firms in our global operations in over 60 countries. Our firm's culture is rooted in our core principles.

How is J.P. Morgan different from other banks that work with startups? The firm has decades of global experience, a robust professional and venture capital network, and scalable treasury management solutions - which can make us the only bank you'll ever need.

In most cases, you may open a J.P. Morgan account with as little as $1,000. You may purchase shares of any of the J.P. Morgan Funds, except the tax-exempt funds, for an Individual Retirement Account including an IRA Rollover or other retirement account.

Any minimums in terms of investable assets, net worth or other metrics will be set by individual wealth managers and their firms. That said, a minimum of $2 million to $5 million in assets is the range where it makes sense to consider the services of a wealth management firm.

Customers can open an account with no startup fees and a $25,000 minimum initial investment. Annual management fees range from 0.6% for clients with $25,000 to $249,999, 0.5% for accounts with $250,000 to $1 million and 0.4% for accounts over $1 million.

In a fast-moving and increasingly complex global economy, our success depends on how faithfully we adhere to our core principles: delivering exceptional client service; acting with integrity and responsibility; and supporting the growth of our employees.