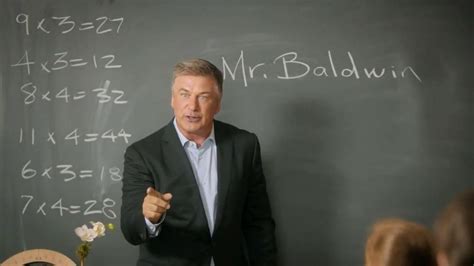

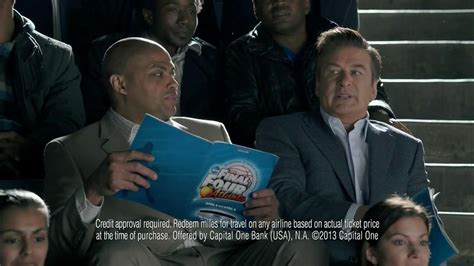

What is Capital One (Credit Card) Venture Card?

Capital One Venture Card is a credit card that provides a variety of benefits to its cardholders. The card is designed for individuals who enjoy traveling and want to earn rewards on their travel-related expenses. One standout feature of the Capital One Venture Card is its generous rewards program.

With the Capital One Venture Card, cardholders earn 2 miles for every dollar spent on purchases made with the card. These miles can be redeemed for travel-related expenses, such as hotel stays and flights. Additionally, the card offers a sign-up bonus of 60,000 miles after spending $3,000 within the first three months of opening the account. This sign-up bonus is worth $600 when redeemed for travel expenses, making it a great value for new cardholders.

Another attractive feature of the Capital One Venture Card is that it has no foreign transaction fees. This makes it a great choice for travelers who frequently use their credit card overseas. Additionally, the card comes with a range of travel benefits, such as travel accident insurance, roadside assistance, and travel assistance services.

The Capital One Venture Card also offers a variety of other perks, such as special access to events and experiences through Capital One's partnership with entertainment and sports companies. Cardholders can also use Capital One's mobile app to manage their account and access a range of account features, such as payment reminders, transaction alerts, and credit score tracking.

Overall, the Capital One Venture Card is a great choice for anyone who wants to earn rewards on their travel expenses. With a generous rewards program, no foreign transaction fees, and a range of travel benefits, it's a credit card that is sure to appeal to many travelers.

Frequently Asked Questions about capital one (credit card) venture card

Capital One Venture Rewards Credit Card Rewards

The Venture card earns 5 miles per dollar on hotels and rental cars booked through Capital One Travel and an unlimited 2 miles per dollar spent on other purchases placing it well on the high-earning end of flat-rate reward cards.

Visa Signature cards

Both the Venture Rewards Card and VentureOne Rewards Card can be issued as Visa Signature cards. This designation provides an array of perks. You can view a full listing of perks on Capital One's website. In addition to these Visa Signature perks, neither card charges foreign transaction fees.

Capital One Venture travel benefits

- Global Entry or TSA PreCheck membership fee credit.

- Capital One transfer partners.

- Airport lounge visits.

- Travel insurance and protections.

- Capital One Entertainment and Capital One Dining.

- Consumer protections.

- Visa Signature benefits.

- Eno assistant and virtual credit card numbers.

The Capital One Venture Card is made of stainless steel and recycled materials and weighs around 16 grams, compared to 5 grams for a traditional credit card made of plastic. Functionally, the metal Capital One Venture Card doesn't work any differently than a plastic credit card, though it will be more durable.

What is the credit limit for Capital One Venture card? The minimum credit limit for the Capital One Venture card is $5,000, since it's a Visa Signature card. Typically, the approved credit limit is $10,000 to $25,000. We've seen credit limits as high as $100,000 on the Capital One Venture card, though.

You can earn miles using any Capital One travel rewards credit card - VentureOne, Venture and Venture X. Cardholders earn unlimited miles on purchases made with their Venture card. And you can earn five miles per dollar on hotels and rental cars booked through Capital One Travel.

Venture capital is a type of private equity investing where investors fund startups in exchange for an ownership stake in the business and future growth potential. Angel investors often kick-start early-stage startups before venture capitalists get involved.

Venture capital (VC) is a form of private equity funding that is generally provided to start-ups and companies at the nascent stage. VC is often offered to firms that show significant growth potential and revenue creation, thus generating potential high returns.

Venture capital funds manage pooled investments in high-growth opportunities in startups and other early-stage firms and are typically only open to accredited investors.

Venture capital plays this role with the help of the following major functions: Venture capital provides finance as well as skills to new enterprises and new ventures of existing ones based on high technology innovations. It provides seed capital to finance innovations even in the pre-start stage.

The Capital One Venture card works like any other travel-rewards credit card. More specifically, this card gives 2 - 5 miles per $1 on purchases. You can then redeem those miles for gift cards, cash back, or travel expenses – with no blackout dates or restrictions.

We recommend that anyone applying for the Capital One Venture Rewards Credit Card have a FICO score of at least 690. With that in mind, credit score alone isn't the only important factor. Your income, current debt, credit history and usage may be considered.

Bottom Line. If your FICO or VantageScore credit score is approximately 670 or higher, you have a history of on-time payments for at least the last year and you haven't declared bankruptcy or defaulted on a loan within five years, you have very good odds of being approved for at least one of Capital One's Venture cards ...

ATM: To withdraw cash with your Capital One Venture from an ATM, you will need a PIN. If you don't have a PIN, call customer service at the number you see on the back of the card to request one. You may also request one through your online account.

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.

They can provide valuable business expertise and connections to help a startup grow and succeed. Venture capitalists typically provide long-term support to their portfolio companies. This support can include additional funding, guidance, and access to a network of resources.