What the Personal Capital TV commercial - Free Financial Tools is about.

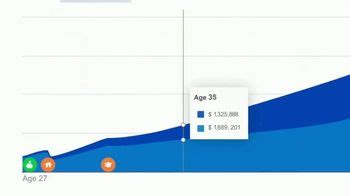

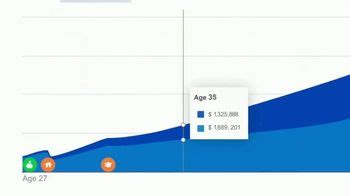

Personal Capital is a popular online financial advisor that offers free financial tools to its users. Their aim is to empower individuals by providing them with the necessary tools to manage their finances effectively.

In one of their recent TV spots, Personal Capital emphasizes the importance of having access to free financial tools. The ad starts with a woman sitting at her desk, surrounded by stacks of paper bills and statements. She looks frustrated and overwhelmed as she tries to make sense of her finances.

Suddenly, a man in a suit walks into the room and introduces himself as her financial advisor from Personal Capital. He tells her that Personal Capital offers free financial tools that can help her get organized and manage her finances more efficiently. He shows her how to use the tools to categorize her expenses, track her investments, and monitor her overall financial health.

The ad ends with a shot of the woman smiling confidently as she realizes how easy it is to manage her finances with the help of Personal Capital's free tools.

Overall, the TV spot effectively showcases the benefits of using Personal Capital's free financial tools. It emphasizes the importance of taking control of your finances and offers a simple and straightforward solution to do so. Personal Capital's free tools are an excellent resource for anyone who wants to stay on top of their finances and achieve financial stability.

Personal Capital TV commercial - Free Financial Tools produced for

Personal Capital

was first shown on television on July 19, 2022.

Frequently Asked Questions about personal capital tv spot, 'free financial tools'

Personal Capital is a financial planning, money management, and investing app in one. It allows you to connect your accounts to the app's dashboard so you can monitor everything in one place. That includes bank accounts, credit cards, retirement accounts, investments, and any other financial account you have.

The bottom line: Empower, formerly known as Personal Capital, has fees that are on the higher end, but anyone can use the robust free tools.

If you're looking for a budgeting platform that provides investment products and services, Personal Capital is arguably the best out there. The company offers a variety of financial tools, including a budget, savings planner, retirement and education planner, an investment checkup and more.

Includes money-tracking dashboard, plus a net-worth tracker as well as a breakdown of your investment portfolio. Offers free investing tools, such as a retirement planner, education planner and fee analyzer to check portfolio fees. Syncs to your bank accounts and credit cards as well as other financial accounts.

Capital budgeting is a process that businesses use to evaluate potential major projects or investments. Building a new plant or taking a large stake in an outside venture are examples of initiatives that typically require capital budgeting before they are approved or rejected by management.

Capital planning is a critical process that ensures a company's long-term success by maintaining and improving its physical assets. In commercial real estate, it is even more important as it has a direct impact on property value, tenant satisfaction, and overall return on investment.

Yes, Personal Capital is safe to use to track your finances, manage your net worth, and plan your retirement. You can do so all for free using their suite of financial tools. They now have over 5 million registered users tracking over $50 billion in assets under management as of 2022.

Free capital refers to the amount of money that is available for investment without incurring any cost. In other words, it is "free" money that can be used to finance various projects or ventures. While this may sound like a good thing, free capital can actually hurt the economy in several ways.

NPV Method is the most preferred method for capital budgeting because it considers the cash flow in the tenure and the cash flow uncertainties through the cost of capital. Moreover, it constantly boosts the company's value, which is void in the IRR and profitability index.

Why Do Businesses Need Capital Budgeting? Capital budgeting is important because it creates accountability and measurability. Any business that seeks to invest its resources in a project without understanding the risks and returns involved would be held as irresponsible by its owners or shareholders.

The best budgeting apps help you understand your income and spending so you have maximum control over your money. Budgeting apps may connect to your bank account and credit cards to automatically download transactions and categorize your spending to match the budget you choose.

Personal Capital is an FDIC-insured online wealth management company known for its financial aggregation app, which pulls together all your financial accounts to calculate your net worth.