What is Personal Capital App?

Personal Capital is a comprehensive personal finance management software and app that provides a range of features to help users manage their money. The app allows users to track their expenses, monitor their investments, and plan for retirement. It's a one-stop-shop for anyone looking to streamline their financial activities.

One of the standout features of the Personal Capital app is its ability to offer customized financial planning services through its robo-advisory platform. The app has in-house financial advisors who leverage a sophisticated algorithm to provide personalized investment advice to users based on their financial goals and risk tolerance.

Personal Capital offers a suite of investment management services for users, including automatic portfolio rebalancing and tax optimization. The app also lets users analyze their investment portfolio's performance and compare it to major market indices like the S&P 500.

Another feature that users of Personal Capital appreciate is the expense tracking feature. By linking their financial accounts, users can categorize and monitor their expenses, which helps them make more informed decisions about how they spend their money.

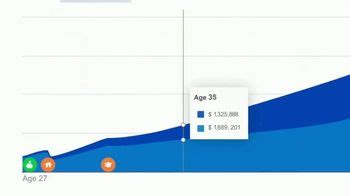

The app also provides users with a retirement planner tool that allows them to estimate the amount of money they will need to retire comfortably. The retirement planner tool also guides users on how to achieve their retirement savings goals.

Personal Capital also offers users a 360-degree financial view, providing insights into their net worth, cash flow, and investment allocation.

In conclusion, Personal Capital is an all-in-one personal finance management solution that offers users a range of features, including robo-advisory services, investment management, and expense tracking. The app is user-friendly and customizable, making it an attractive choice for anyone looking to manage their money effectively.

Frequently Asked Questions about personal capital app

Personal Capital is a financial planning, money management, and investing app in one. It allows you to connect your accounts to the app's dashboard so you can monitor everything in one place. That includes bank accounts, credit cards, retirement accounts, investments, and any other financial account you have.

It encompasses budgeting, banking, insurance, mortgages, investments, and retirement, tax, and estate planning. The term often refers to the entire industry that provides financial services to individuals and households and advises them about financial and investment opportunities.

The answer is that Personal Capital doesn't make any money from its free financial app. Instead, their free financial app acts as a lead generator for them to contact those users who link more than $100,000 in investable assets. A portion of those contact will eventually become clients.

In 2020, Empower Retirement acquired Personal Capital, and the two platforms combined strengths to deliver a more comprehensive and personalized investment management and retirement planning solution.

Accessibility and Ratings. The Personal Capital app is available on your web browser, as well as on iOS and Android mobile devices. The company's mobile app has 4.7 stars across more than 36,000 reviews in the Apple App Store and 4.3 stars over more than 16,000 reviews in the Google Play Store.

Is Personal Capital safe? Personal Capital is a trustworthy and legitimate FDIC-insured company and offers several services. In terms of cash management, Personal Capital Cash is a good fit for those who want to track their spending, investments and overall net worth on a single platform.

A financial product is an instrument in which a person can either: make a financial investment (for example, a share); borrow money (for example, credit cards, loans or bonds); or. save money (for example, term deposits).

What Are the Five Areas of Personal Finance? Though there are several aspects to personal finance, they easily fit into one of five categories: income, spending, savings, investing and protection. These five areas are critical to shaping your personal financial planning.

Cons of Personal Capital

One of the biggest downsides to Personal Capital is cost. If you choose to sign up with Personal Capital Advisors, you will be eating a 0.89% fee. This fee is much higher than what you might be paying to other robo-advising services, like Wealthfront or Betterment.

NPV Method is the most preferred method for capital budgeting because it considers the cash flow in the tenure and the cash flow uncertainties through the cost of capital. Moreover, it constantly boosts the company's value, which is void in the IRR and profitability index.

Vyzer (Best Personal Capital Alternative for High-Net-Worth Individuals) represents the best Personal Capital alternative for high-net-worth individuals found on this list. It offers investment portfolio tracking, financial planning tools, and wealth management solutions for both public and private investments.

The Empower (formerly Personal Capital) budgeting app is one exception that has advanced tools for all your financial planning. Out of a dozen-plus apps that Select compared when rating the best budgeting apps, Empower stood out for being the best app for investors.

Most businesses use capital as a way to grow. Capital helps a company grow by providing the assets it needs to generate more revenue. A company that expands physically, adds new technologies or relocates might need additional cash to purchase new facilities or hire new personnel.

(15) Financial product or service (A) In general The term “financial product or service” means - (i) extending credit and servicing loans, including acquiring, purchasing, selling, brokering, or other extensions of credit (other than solely extending commercial credit to a person who originates consumer credit ...

Examples of financial products include but are not limited to the following: stocks, bonds, derivatives, and currencies.

According to Investopedia, “Personal finance defines all financial decisions and activities of an individual or household, including budgeting, insurance, mortgage planning, savings and retirement planning.” Understanding these terms can help you better control your funds and prepare for future financial success.