What is Personal Capital Finance?

Personal Capital Finance is a web-based investment and wealth management platform that provides financial planning tools and a comprehensive overview of an individual's financial health. The platform combines automated investing with personalized advice from certified financial planners.

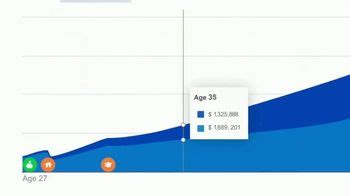

One of the key features of Personal Capital Finance is that it offers a free financial dashboard that provides an aggregated view of all of a user's financial accounts, including bank accounts, credit cards, retirement accounts, and investment portfolios. This allows users to easily track their net worth, monitor their spending, and gain insights into their overall financial health.

Personal Capital Finance also offers a range of investment services, including automated investing through its robo-advisor service, as well as customized wealth management services provided by real human advisors. The platform provides access to a variety of investment options, including ETFs, individual stocks, and mutual funds.

One of the unique aspects of Personal Capital Finance is its focus on financial education. The platform offers a library of educational content, including articles, videos, and webinars, that is designed to help users improve their financial literacy and make informed investment decisions.

Overall, Personal Capital Finance is a powerful tool for individuals who want to take control of their finances and improve their long-term financial health. Its comprehensive dashboard, investment services, and educational resources make it an attractive option for both novice and experienced investors alike.

Frequently Asked Questions about personal capital finance

Personal finance is about meeting your financial goals and understanding all the routes to do this, from saving and investing, and keeping debt under control, to buying a home to planning for retirement - and coming up with a plan to accomplish these goals.It's also the name of the industry that provides financial ...

(finance) Financial resources or other wealth belonging to a particular person, especially when used for investment purposes.

Personal Capital is a financial planning, money management, and investing app in one. It allows you to connect your accounts to the app's dashboard so you can monitor everything in one place. That includes bank accounts, credit cards, retirement accounts, investments, and any other financial account you have.

Personal finance, as a term, covers the concepts of managing your money, saving, and investing. It also includes banking, budgeting, mortgages, investments, insurance, retirement planning, and tax planning.

Though there are several aspects to personal finance, they easily fit into one of five categories: income, spending, savings, investing and protection. These five areas are critical to shaping your personal financial planning.

A financial product is an instrument in which a person can either: make a financial investment (for example, a share); borrow money (for example, credit cards, loans or bonds); or. save money (for example, term deposits).

Personal Capital, the San Francisco fintech that lets people invest in automated portfolios of stocks and bonds, is being bought by Empower Retirement for $825 million upfront, plus $175 million if growth goals are reached over two years.

Financial capital is money, credit, and other forms of funding that build wealth for people and businesses. Businesses use financial capital to buy more equipment, buildings, or materials, which they use to make goods or provide services.

Capital structure is nothing but how a firm finances itself. Firms need money to operate. How do they get that money? They have a couple of choices – just rely on the profit they generate, issue shares to investors (issue equity) or borrow money from investors (issue debt).

Is Personal Capital safe? Personal Capital is a trustworthy and legitimate FDIC-insured company and offers several services. In terms of cash management, Personal Capital Cash is a good fit for those who want to track their spending, investments and overall net worth on a single platform.

Areas of Personal Finance. The five areas of personal finance are income, saving, spending, investing, and protection.

And now, we will discuss each of the 5 aspects in further detail:

- #Number 1: Saving. The need for sudden money can come anytime.

- #Number 2: Investing. We often confuse investing with saving, or consider them to be synonymous.

- #Number 3: Financial protection.

- #Number 4: Tax Saving.

- #Number 5: Retirement planning:

- Bottom Line.

The term 'financial service' includes, in relation to a financial. product, providing advice, dealing, making a market, operating a registered managed. investment scheme or providing a custodial or depository service. A 'financial. product' includes a security, a derivative, an interest in a managed investment.

- Concept of New Financial Products. The first step in developing a new financial product is to conceptualize it.

- Product Development.

- Regulatory, Legal Requirements.

- Operations.

- Registration of Products.

- Marketing New Financial Products.

- Distribution of the New Product.

- Product Launch.

Some examples include mobile banking, peer-to-peer payment services (e.g., Venmo, CashApp), automated portfolio managers (e.g., Wealthfront, Betterment), or trading platforms such as Robinhood. It can also apply to the development and trading of cryptocurrencies (e.g., Bitcoin, Dogecoin, Ether).

Fintech platforms emerged, offering centralized and user-friendly solutions to track accounts, avoid unexpected expenses, and make informed financial decisions. By providing access to comprehensive financial information, fintech platforms empower users to take charge of their financial well-being.