What the Credit Sesame TV commercial - Free Credit Score Testimonials is about.

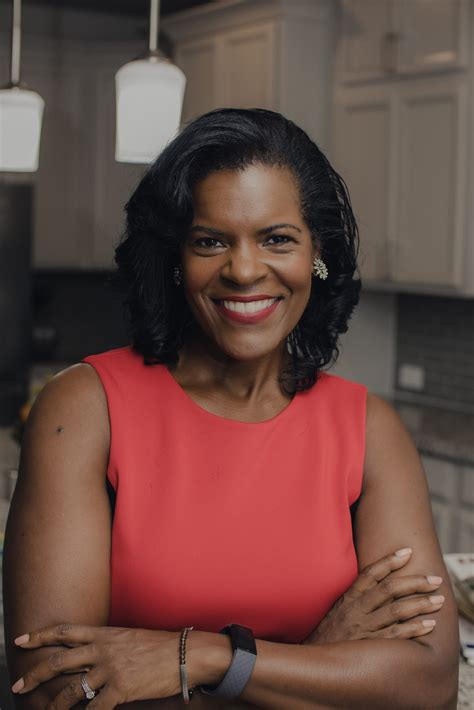

Credit Sesame TV Spot, 'Free Credit Score Testimonials'

: "Are you curious about your credit score? Wondering how it affects your financial future?"

: "Credit Sesame understands that everyone's financial journey is unique. That's why they offer free credit scores and insights tailored just for you."

: "Join over 15 million Credit Sesame members who are taking control of their credit scores. It's simple, it's free, and it could change your life."

: "Get your free credit score today at creditsesame.com."

[The screen fades to black, leaving viewers inspired and motivated to take charge of their financial well-being.]

---

Note: This fictional TV spot aims to convey the benefits of using Credit Sesame to monitor and improve one's

Credit Sesame TV commercial - Free Credit Score Testimonials produced for

Credit Sesame

was first shown on television on September 15, 2018.

Frequently Asked Questions about credit sesame tv spot, 'free credit score testimonials'

Credit Sesame is a free personal financial management tool. Credit Sesame specializes in tracking and monitoring the financial debts of each user. The company will provide recommendations to its user on how to lower their debt best.

VantageScore® 3.0

The credit score you see on Credit Sesame is based on the VantageScore® 3.0 scoring model. It's provided by TransUnion, but when you upgrade to our premium services, we show your score from all three credit bureaus. You'll also get access to many other resources to help protect your credit.

Credit Sesame is safe and uses the same security measures as banks and the government to keep your information safe and secure. Credit Sesame is not a scam; it is providing a legitimate service. Safeguarding your information is extremely important for them to keep your credit accurate and protected.

Yes, Credit Sesame is legit. It monitors and analyzes your credit report to help you protect yourself against identity theft and make sound financial decisions. Credit Sesame also uses industry-standard encryption to keep your information safe.

Some benefits of getting the Sesame Cash card are:

- Monitor and improve your credit score.

- Get rewarded for improving your credit score.

- No account fees and no hard credit check.

- Early payday (if you set up a direct deposit load)

- Monitor your spending habits.

In addition to the detailed information, Credit Sesame provides based on your credit report, it also gives you a grade based on common market trends. They also give recommendations on how to improve or maintain your credit score and explain what factors impact your score most.

Some benefits of getting the Sesame Cash card are:

- Monitor and improve your credit score.

- Get rewarded for improving your credit score.

- No account fees and no hard credit check.

- Early payday (if you set up a direct deposit load)

- Monitor your spending habits.

between 690 to 719

Generally speaking, scores between 690 to 719 are considered good in the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range.

Sesame Cash is a digital bank account that comes with a prepaid Mastercard debit card. In order to offer this account, we've partnered with Community Federal Savings Bank (CFSB), Member FDIC.

Absolutely! While we do have premium subscription options for members that want more bells and whistles, our core product of offering a free single credit bureau (TransUnion) monthly credit score and free credit monitoring is in fact free of charge and does not require a credit card.

What are the advantages of credit?

- Cash flow. Cash flow refers to the money flowing in and out of your accounts.

- Credit card rewards. Many credit cards offer rewards or cash back.

- Fraud prevention.

- Purchase protection.

- Building credit.

- Buying more than you can afford.

- Interest.

- Annual fees.

Here's a look at how good credit can benefit you.

- Borrow money at a better interest rate.

- Qualify for the best credit card deals.

- Get favorable terms on a new cell phone.

- Improve your chances of renting a home.

- Receive better car and home insurance rates.

- Skip utility deposits.

- Get a job.