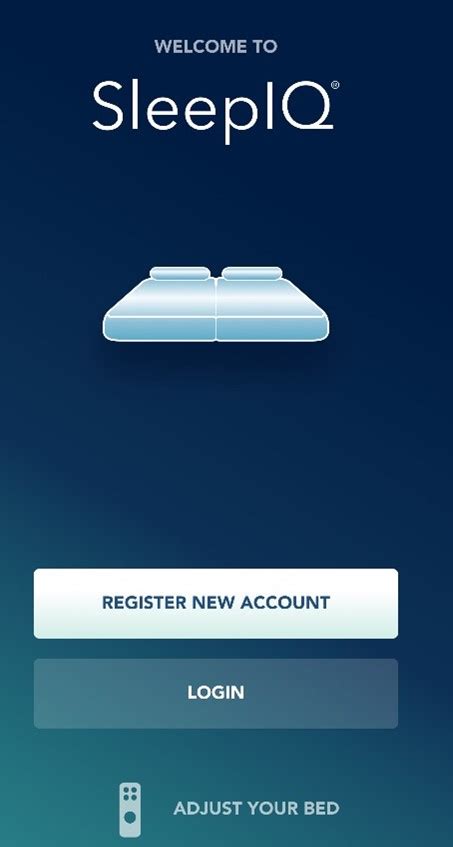

What is Credit Sesame App?

Credit Sesame is an innovative financial application that provides free credit and financial services to its users. It is an app-based service that helps users to get an accurate picture of their credit health, which in turn allows them to make informed decisions about their finances.

With the Credit Sesame App, users can easily monitor and track their credit score, as well as receive credit alerts and personalized recommendations to improve their score. The app also provides free credit monitoring, which quickly identifies any changes, such as unauthorized activity, on users' accounts. In addition, Credit Sesame offers tips on how to improve users' credit profile and recommends other financial products that can help them achieve their financial goals.

One of the key features of the Credit Sesame App is its user-friendly interface and easy-to-navigate dashboard. The app also provides various financial tools and resources to help users better manage their finances. These tools include financial advice, budgeting tools, and personalized recommendations based on users' unique financial goals and profiles.

Credit Sesame's mission is to help consumers achieve their financial goals. With its user-friendly interface, personalized recommendations, and various financial tools, the Credit Sesame App is a valuable resource for anyone looking to improve their credit health and achieve financial stability.

Frequently Asked Questions about credit sesame app

Credit Sesame is a free personal financial management tool that assists users with monetary liabilities. While other financial management tools incorporate bank accounts, retirement investments, and target savings goals, Credit Sesame stays on the debt side of the transaction.

credit and loan company

Credit Sesame is a credit and loan company that makes consumer credit and loan management simple and automated.

VantageScore® 3.0 scoring

The credit score you see on Credit Sesame is based on the VantageScore® 3.0 scoring model. It's provided by TransUnion, but when you upgrade to our premium services, we show your score from all three credit bureaus. You'll also get access to many other resources to help protect your credit.

But it doesn't work like traditional secured cards that require a security deposit and allow you to make purchases up to the credit limit. Instead, funds from your Sesame Cash debit account are used to set your credit limit, and select purchases from this card help build your credit history.

Credit Sesame is the Program Manager for your Sesame Cash account, which is an account held by Community Federal Savings Bank. Credit Sesame provides administration and operational services to support your Sesame Cash account.

Sesame Cash users can withdraw funds at Allpoint ATM's, free of charge.

Credit Sesame now offers a free prepaid debit card account to its customers that replaces a traditional bank account and that will provide additional financial wellness tools. The Card is not connected in any way to any other account, such as a checking or savings account. The Card is not a credit card.

Sesame Cash users can withdraw funds at Allpoint ATM's, free of charge.

Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

When loading funds using the Linked Bank Transfer method, your funds will not appear in your Sesame Cash account right away. Average wait time is 2-3 business days.

Credit Sesame is the Program Manager for your Sesame Cash account, which is an account held by Community Federal Savings Bank. Credit Sesame provides administration and operational services to support your Sesame Cash account.

Most banks offer 20% - 40% of the total credit limit as cash limit. For instance, if the total credit limit on a card is Rs. 1 lakh, you can withdraw up to Rs. 20,000 to Rs.

If you're looking for ways to improve your chances of getting an increased credit limit, focus on the following things:

- Maintain a good credit score.

- Reduce your outstanding debt.

- Include all sources of income.

- Avoid the need to open a second card.

- Earn more rewards.

- Low credit utilization.

The credit limit is the total amount of money that a user can spend with his or her credit card, as opposed to the cash limit, which is the total amount of money that a user can withdraw in cash with his or her credit card. Typically, the cash limit is 20% to 40% of the user's credit limit.

Your credit limit is the maximum, in total, you can borrow on your credit card at any one time. Your credit limit is usually based on your credit score and individual circumstances. Just like your credit score, it can go up or down over time.

Generally speaking, banks and lenders may grant credit limits based on a person's credit risk profile, history, and other factors. However, the maximum credit limit offered in India can be anywhere from Rs. 50,000 to even Rs. 10 Lakhs, depending on the lender.