NetSpend Card All-Access Card TV commercial - Avoid Overspending

Advertisers

Advertisers of the NetSpend Card All-Access Card TV Spot, 'Avoid Overspending'

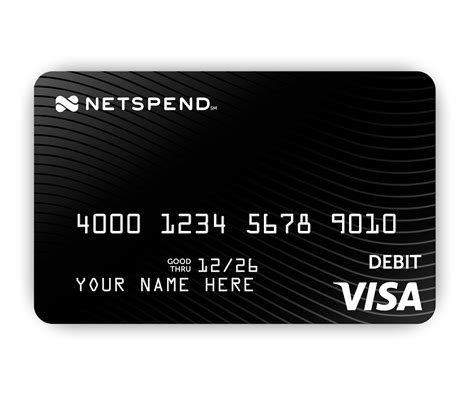

NetSpend Card

NetSpend Card is a popular financial service company that offers a convenient and innovative solution for managing money. With a focus on providing accessible financial tools, NetSpend Card has gained...

What the NetSpend Card All-Access Card TV commercial - Avoid Overspending is about.

The NetSpend Card All-Access Card TV spot is a captivating advertisement that emphasizes the importance of avoiding overspending with the use of the NetSpend Card All-Access Card. The commercial starts with an individual, who is out shopping, reaching for his traditional credit card to make a purchase, but then quickly remembers the dangers of overspending and reaches for his NetSpend card instead.

As the ad continues, the narrator highlights various features of the NetSpend Card All-Access Card that help its users avoid overspending. These include the ability to only spend the amount loaded onto the card, so there's no danger of getting into debt, as well as the card's "pay as you go" feature which allows individuals to only pay for their purchases and avoid any additional fees.

The commercial also focuses on how easy and quick it is to load funds onto the NetSpend Card All-Access Card. It can be done either through direct deposit, transferring funds from a bank account, or even by using cash at any of the 130,000+ NetSpend Reload Network locations across the country.

Overall, the NetSpend Card All-Access Card TV spot effectively showcases the benefits and features of the card, particularly when it comes to avoiding overspending. The advertisement is professional, engaging, and informative, making it a must-see for anybody looking for a reliable, efficient, and non-risky payment method.

NetSpend Card All-Access Card TV commercial - Avoid Overspending produced for NetSpend Card was first shown on television on May 11, 2021.

Frequently Asked Questions about netspend card all-access card tv spot, 'avoid overspending'

Videos

Watch NetSpend Card All-Access Card TV Commercial, 'Avoid Overspending'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in NetSpend Card All-Access Card TV Spot, 'Avoid Overspending'

Products

Products Advertised

TV commercials

Similar commercials