AAG Reverse Mortgage TV commercial - Home Equity Chair

Advertisers

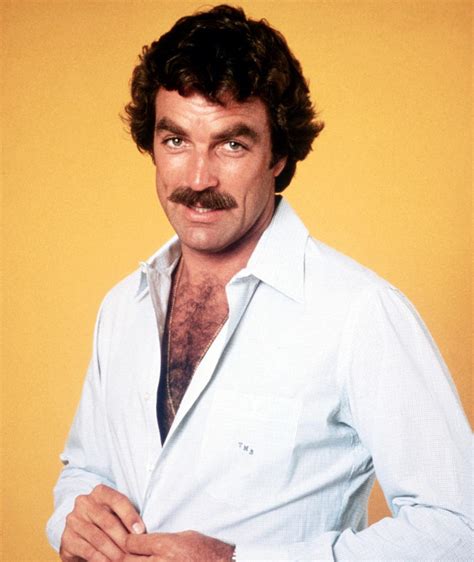

Advertisers of the AAG Reverse Mortgage TV Spot, 'Home Equity Chair' Featuring Tom Selleck

American Advisors Group (AAG)

American Advisors Group (AAG) is a company that specializes in providing reverse mortgage loans and other home equity retirement solutions. With a focus on helping seniors build a more financially sec...

What the AAG Reverse Mortgage TV commercial - Home Equity Chair is about.

The AAG Reverse Mortgage TV Spot featuring Tom Selleck is an engaging and informative commercial that highlights the benefits of a reverse mortgage for senior homeowners. In the commercial, Tom Selleck is seen seated on a stylish home equity chair, with a homey and inviting ambiance.

Selleck talks about how a reverse mortgage can help seniors to tap into their home equity and access the funds they need to enjoy their retirement years to the fullest. He explains how a reverse mortgage works, allowing seniors to access the equity in their home while still retaining ownership and living in the house.

The commercial also emphasizes the importance of finding a reliable and trustworthy lender like AAG Reverse Mortgage, which has been in the reverse mortgage business for more than a decade and has helped thousands of homeowners secure their financial future.

One of the most compelling features of the AAG Reverse Mortgage is the flexibility it offers the senior homeowners. With the funds from a reverse mortgage, seniors can pay off their existing mortgage or other outstanding debts, cover medical expenses or home improvements, or simply use the funds as an extra source of income to enjoy life.

In conclusion, the AAG Reverse Mortgage TV spot featuring Tom Selleck is a well-crafted commercial that educates senior homeowners about the potential benefits of a reverse mortgage. The use of Tom Selleck's relaxed demeanor and stylish home equity chair, creates an inviting and approachable setting for viewers to learn more about the reverse mortgage option.

AAG Reverse Mortgage TV commercial - Home Equity Chair produced for American Advisors Group (AAG) was first shown on television on June 7, 2022.

Frequently Asked Questions about aag reverse mortgage tv spot, 'home equity chair' featuring tom selleck

Videos

Watch AAG Reverse Mortgage TV Commercial, 'Home Equity Chair'

We analyzed TV commercials placed on popular platforms and found the most relevant videos for you:

Actors

Actors who starred in AAG Reverse Mortgage TV Spot, 'Home Equity Chair' Featuring Tom Selleck

Products

Products Advertised

TV commercials

Similar commercials