What is GEICO Renters Insurance?

GEICO Renters Insurance is a type of insurance policy designed to provide coverage for individuals who rent their homes or apartments. This type of insurance provides protection for personal belongings, personal liability, and additional living expenses if you are forced to temporarily relocate due to unexpected events.

With GEICO Renters Insurance, your personal belongings, such as your furniture, electronics, and clothing, are covered from theft, fire, and other unexpected events that may happen. This coverage helps ensure that you will be able to replace your items if they are damaged or stolen.

The policy also provides you with personal liability coverage. This means that if someone is injured in your rental unit or if you accidentally damage your neighbor's property, the insurance policy will pay for these damages up to the policy's limit.

In addition, GEICO Renters Insurance includes coverage for additional living expenses. This means that if you are forced to temporarily relocate due to damage to your rental unit, the policy will pay for reasonable expenses, such as hotel or temporary rental fees, while your unit is being repaired.

Overall, GEICO Renters Insurance is an affordable way for renters to protect themselves and their belongings from unforeseen events. With easy enrollment and customizable coverage options, renters can select the policy that best fits their individual needs.

Frequently Asked Questions about geico renters insurance

In addition to auto insurance, GEICO can help you with: Motorcycle, ATV, RV, and Boat insurance. Homeowners, Renters, Condo, Co-op, and Mobile Home insurance. Personal Umbrella Protection.

Renters insurance is for people who rent or lease the properties they live in. It covers the loss or damage of the personal property you keep inside your home. It's a good idea to prepare a home inventory to ensure your coverage doesn't fall short if you need it know what you're protecting.

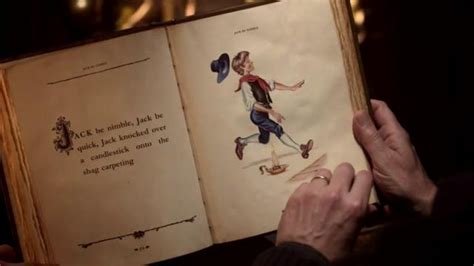

"Named Peril" is the most common renter's or homeowner's policy. It will cover personal belongings against specifically named events such as fire, explosion, smoke, vandalism, and water-related damage. The burden of proof is on the claimant, who must show that a loss was caused by a named peril.

Personal liability: Protects you if someone is injured in your home and pays legal costs if you are liable and taken to court.

Geico's success as an insurance company has come from offering consumers independence and low prices, as well as rolling out effective advertising campaigns that highlight savings. Chief among the forces behind Geico's success is the insurer's innovative and user-friendly initiatives.

Insurance is a way to manage your risk. When you buy insurance, you purchase protection against unexpected financial losses. The insurance company pays you or someone you choose if something bad happens to you. If you have no insurance and an accident happens, you may be responsible for all related costs.

Life insurance policy benefits can be used to help pay for final expenses after you pass away. This may include funeral or cremation costs, medical bills not covered by health insurance, estate settlement costs and other unpaid obligations.

An insurance premium is the amount you pay each month (or each year) to keep your insurance policy active. Your premium amount is determined by many factors, including risk, coverage amount and more – depending on the type of insurance you have. This does not apply to all types of life insurance.

Tenant insurance could cover your belongings against common risks such as theft, fire, loss and much more. It's an easy and affordable way to protect your investment in your personal property. Coverage applies to your belongings that are both in your home and temporarily away, such as when you go on vacation.

How much does renters insurance cost in Colorado? The average cost of renters insurance in Colorado is $128 per year or around $11 per month. Compared to the national average, Colorado's rate is 20% lower.

How much is renters insurance in Texas? The average cost of renters insurance in Texas is $173 a year, or about $14 a month. That's about 17% more than the national average of $148 a year. In most U.S. states, including Texas, many insurers use your credit-based insurance score to help set rates.

Key Takeaways: Backed by over 800 hours of research, our team considers Geico insurance to be the option that's Best for Budget-Friendly Drivers. We found that Geico has some of the lowest car insurance rates for good drivers, costing $461 per year for minimum coverage and $1,596 per year for full coverage.

Not only does GEICO offer some of the most affordable coverage, but it also has solid customer satisfaction ratings. The company maintains an A- rating with Better Business Bureau (BBB) and a relatively high J.D. Power score for customer satisfaction.

Insurance is a financial safety net, helping you and your loved ones recover after something bad happens - such as a fire, theft, lawsuit or car accident. When you purchase insurance, you'll receive an insurance policy, which is a legal contract between you and your insurance provider.

Insurance in general is meant to protect you financially if something bad happens that is expensive to fix or recover from. You might get insurance for your car, life, your apartment, or even your phone. When you have insurance, you pay a little bit each month.

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.