What is GoMedicare Medicare?

GoMedicare is not mentioned in the provided search results. However, if you are referring to Medicare.gov, it is the official website for Medicare, the federal health insurance program for people who are 65 or older, certain younger individuals with disabilities, and people with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis (ALS).

Medicare.gov provides a wealth of information and resources for beneficiaries, including details about different parts of Medicare, coverage options, enrollment periods, prescription drug coverage, and more. It is a trusted source for beneficiaries to find important information about their Medicare benefits.

If you have specific questions about Medicare or need assistance with any aspect of the program, I recommend visiting the Medicare.gov website or reaching out to their customer service for further assistance. However, if you are referring to a different term or company as "GoMedicare Medicare," please provide additional information, and I will be happy to assist you further.

Frequently Asked Questions about gomedicare medicare

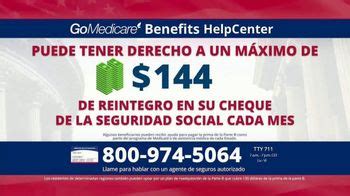

GoMedicare is part of GoHealth, a health insurance comparison tool. Like GoHealth, Medicare shoppers can compare Medicare insurance plans from multiple companies. With GoMedicare, clients work with a licensed insurance agent to find the best deal on Medicare options.

To qualify for a Medicare giveback benefit, you must be enrolled in Medicare Part A and B. You must be responsible for paying the Part B Premiums; you should not rely on state government or other local assistance for your Part B premiums.

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with 28% of all enrollment. Plans are well-rated and have affordable premiums and add-on benefits, a valuable combination that could account for AARP/UHC having the largest number of Medicare Advantage enrollees.

Our Top Medicare Supplement (Medigap) Plans

- Humana.

- AARP by UnitedHealthcare.

- Blue Cross Blue Shield.

- Cigna.

- State Farm.

To qualify for the giveback, you must:

- Be enrolled in Medicare Parts A and B.

- Pay your own premiums (if a state or local program is covering your premiums, you're not eligible).

- Live in a service area of a plan that offers a Part B giveback.

So what's the catch? Of course, no Medicare Advantage plan is really $0 cost. You may still pay deductibles and copays for covered services, and you'll still have to pay the Part B premium. But depending on your own personal healthcare needs, a Medicare Advantage plan may be worth it for the added benefits.

Have you heard about the Social Security $16,728 yearly bonus? There's really no “bonus” that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

How do I qualify for the giveback?

- Are enrolled in Part A and Part B.

- Do not rely on government or other assistance for your Part B premium.

- Live in the zip code service area of a plan that offers this program.

- Enroll in an MA plan that provides a giveback benefit.

Limited Network of Providers

Another common reason why people leave their Medicare Advantage plan is due to network restrictions. Going out of the network for care could result in high fees. Even if you have a Preferred Provider Organization (PPO) plan, you'll pay more to visit doctors that aren't in the network.

One of the biggest differences between Part C plans and Original Medicare (also known as fee-for-service) is that Medicare Advantage often has limited networks of doctors and hospitals and charges you more to see out-of-network providers - if you're allowed to see them at all.

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans. However, this may not always be the case, and you should shop around to find the best plan option for you.

AARP/UnitedHealthcare is the best overall company for Medicare Supplement plans because of its low rates and valuable extras.

- $136/mo. AARP: Best overall Medigap. AARP: Best overall Medigap.

- $142/mo. Aetna: Best for adding Part D.

- $147/mo. BCBS: Most popular Medigap.

- $154/mo. Cigna: Best high-deductible.

Imagine having a $0 monthly cost insurance plan that also gives you back $100 or more each month. While it sounds like a scam, it's been around for over a decade and is completely legitimate. Think of it this way: the Medicare Advantage companies get X money from the government each month.

$164.90

Monthly Medicare Premiums for 2023

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount |

|---|

| Individuals with a MAGI of less than or equal to $97,000 | 2023 standard premium = $164.90 |

| Individuals with a MAGI above $97,000 and less than $403,000 | Standard premium + $362.60 |

While many physicians work within the Medicare Advantage networks with few problems, the plans do not come without issues. One of the primary challenges doctors face is referral and pre-authorization requirements that may impede a patient's needed medical care.

One must either be over the age of sixty-five, blind and/or disabled. Additionally, they must have a limited income and resources as the program is need-based and aims to assist beneficiaries to cover basic costs for food and shelter.