What the Interactive Brokers TV commercial - Lower Costs to Maximize Your Return is about.

Interactive Brokers TV Spot, 'Lower Costs to Maximize Your Return'

: In the fast-paced world of investing, every moment counts. That's why at Interactive Brokers, we're revolutionizing the way you trade.

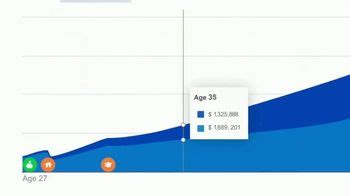

: Our cutting-edge technology and low-cost structure give you the power to maximize your returns like never before.

: Whether you're a seasoned investor or just starting out, we believe that lowering costs leads to higher profits.

: With our lightning-fast execution and state-of-the-art platform, you'll have the tools you need to seize opportunities quickly.

: Join the millions of investors who trust Interactive Brokers to help them navigate the markets and make their money work harder.

: Lower costs, higher returns. Interactive Brokers, the smarter way to invest.

[End with the Interactive Brokers logo and contact information displayed on screen]

Disclaimer: Interactive Brokers does not provide investment advice. Trading on margin involves risk and is not suitable for all investors.

Interactive Brokers TV commercial - Lower Costs to Maximize Your Return produced for

Interactive Brokers

was first shown on television on September 4, 2013.

Frequently Asked Questions about interactive brokers tv spot, 'lower costs to maximize your return'

Interactive Brokers offers a range of trading platforms tailored to meet the requirements of active traders and long-term investors. Its platform receives high acclaim from active traders who value the comprehensive features available on the desktop trading platform.

Interactive Brokers at a glance

| Account minimum | $0 |

|---|

| Options trades | IBKR Lite: No base commission; 65 cents per contract. IBKR Pro: No base commission; 15 to 65 cents per contract depending on commission structure (volume discount available). |

| Account fees (annual, transfer, closing, inactivity) | None. |

Client securities accounts at Interactive Brokers LLC are protected by the Securities Investor Protection Corporation ("SIPC") for a maximum coverage of $500,000 (with a cash sublimit of $250,000).

The number of active trading accounts is a key metric for brokerages like Interactive Brokers because they make money from users placing trades through their platform. The more people making trades, the greater the amount the company can earn from commissions, margin loans, and other fees.

Best stock brokers for Europeans in 2023

- Interactive Brokers. Stock score: 5.0/5.

- eToro. Stock score: 4.9/5.

- Fidelity. Stock score: 4.6/5.

- TD Ameritrade. Stock score: 4.4/5.

- Merrill Edge. Stock score: 4.4/5.

- Charles Schwab. Stock score: 4.4/5.

- Zacks Trade. Stock score: 4.3/5.

- SoFi Invest. Stock score: 4.3/5.

In order to day trade, the account must have at least 25,000 USD in Net Liquidation Value, where Net Liquidation Value includes cash, stocks, options, and futures P+L.

The NYSE regulations state that if an account with less than 25,000 USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days.

The interest rates for margin trading on Interactive Brokers (IB) may appear low for several reasons: Low Base Rates: The primary factor influencing margin interest rates is the base rate set by central banks, like the Federal Reserve in the United States.

A few decades ago, if you wanted to become a day trader, you had to have a lot of money, access to brokers, and extensive skills. Today, it's possible to start day trading with as little as $1,000 or less. This is especially true when talking about trading in the Forex arena.

Is Interactive Brokers better than eToro? In our analysis of 23 international regulators across 62 of the best forex brokers, Interactive Brokers is considered Highly Trusted, with an overall Trust Score of 99 out of 99. eToro is considered Highly Trusted, with an overall Trust Score of 90 out of 99.

Why are Interactive Brokers margin rates so low? Interactive Brokers ' margin rates are low because they monetize other aspects of their service (like subscription to market data, pro account monthly fees, and so on).

We have a custodial arrangement with Interactive Brokers LLC to provide these services to you. Unlike a mutual fund investor, you continue to be the direct owner of the underlying securities that are held in your own brokerage account.