AAG Reverse Mortgage Loans TV commercial - Gotta Say Something

Advertisers

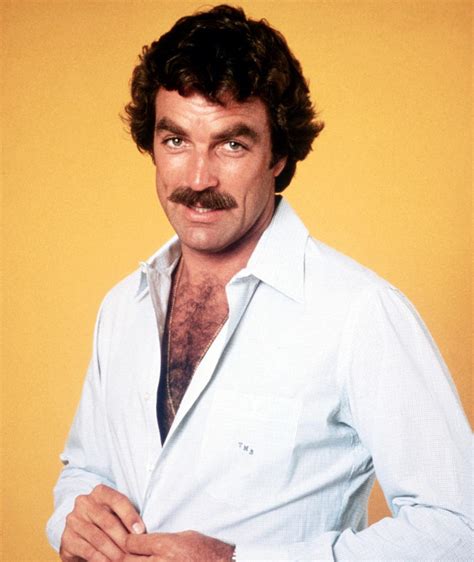

Advertisers of the AAG Reverse Mortgage Loans TV Spot, 'Gotta Say Something' Featuring Tom Selleck

American Advisors Group (AAG)

American Advisors Group (AAG) is a company that specializes in providing reverse mortgage loans and other home equity retirement solutions. With a focus on helping seniors build a more financially sec...

What the AAG Reverse Mortgage Loans TV commercial - Gotta Say Something is about.

The AAG Reverse Mortgage Loans TV Spot, 'Gotta Say Something' Featuring Tom Selleck is an advertisement that showcases the benefits of reverse mortgage loans to senior citizens. The advertisement features Tom Selleck; an iconic Hollywood actor, who is also a real-life reverse mortgage loan customer and AAG brand ambassador.

The TV spot starts with Tom Selleck standing in front of a beautiful house, talking about the hard work and dedication that he put into owning his dream home. He then goes on to mention that as he got older, the expenses of maintaining the home just kept adding up, and he needed a way to take care of them without necessitating selling the house. This is when he turned to AAG Reverse Mortgage Loans.

The advertisement goes on to explain how AAG Reverse Mortgage Loans can help senior citizens like Tom Selleck to turn the equity in their homes into cash, which can be used to pay for daily expenses, medical bills or paying off a mortgage. It is highlighted that reverse mortgage loans from AAG don't require monthly mortgage payments, allowing the borrower to stay in their home for as long as they want.

The TV spot concludes with Tom Selleck urging seniors to take advantage of the benefits of reverse mortgage loans. Overall, the AAG Reverse Mortgage Loans TV Spot featuring Tom Selleck effectively appeals to senior citizens who are looking for ways to maintain their homes and pay for daily expenses in retirement. By using a relatable and trustworthy spokesperson like Tom Selleck, the advertisement instills trust and confidence in the viewers and assures them of the reliability of AAG Reverse Mortgage Loans.

AAG Reverse Mortgage Loans TV commercial - Gotta Say Something produced for American Advisors Group (AAG) was first shown on television on February 24, 2021.

Frequently Asked Questions about aag reverse mortgage loans tv spot, 'gotta say something' featuring tom selleck

Videos

Watch AAG Reverse Mortgage Loans TV Commercial, 'Gotta Say Something'

Unfortunately we were unable to find any suitable videos in the public domain. Perhaps the video of this TV commercial has not been preserved. If you know the link to this commercial, you can send it to us using a special form.

Actors

Actors who starred in AAG Reverse Mortgage Loans TV Spot, 'Gotta Say Something' Featuring Tom Selleck

Products

Products Advertised

TV commercials

Similar commercials