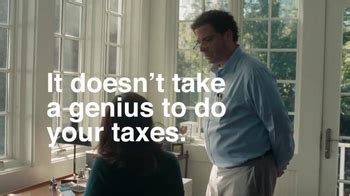

What is TurboTax?

TurboTax is a tax preparation software developed by Intuit that simplifies the process of tax filing for individuals, small business owners, and self-employed persons. With over 30 years in the tax preparation industry, TurboTax has helped millions of people accurately file their taxes with ease.

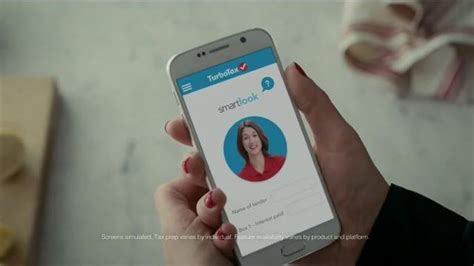

One of the advantages of TurboTax is its user-friendly interface, which guides users through the tax preparation process step-by-step, helping them to identify available tax credits and deductions that could reduce their tax liability. TurboTax also has a feature called SmartLook, which allows users to connect with a tax professional via video chat or phone to receive personalized tax advice and lock-in a tax return before filing it.

TurboTax offers a variety of packages to meet individual and business tax needs, such as the Deluxe package for those with deductions, the Premier package for investors and rental properties, and the Self-Employed package for entrepreneurs and business owners. Users can also choose to file their state taxes with TurboTax, making it a one-stop-shop for filing tax returns.

Overall, TurboTax offers a convenient, reliable, and cost-effective solution for tax preparation needs.

Frequently Asked Questions about turbotax

TurboTax can help find you any new tax deductions and credits. for free guidance from a trained tax professional. when your tax return is accepted.

At TurboTax we make it easy to get your taxes done right by letting you start when you want on any device and this year you can pick up where you left off on your smartphone tablet or computer. We're

Pros

- Step-by-step guidance with a Q&A format that is easy to follow.

- TurboTax Live provides on-demand advice and a final review from a tax expert.

- Live Full Service has a tax expert prepare, sign, and file your return.

- Accuracy and maximum refund guaranteed*

TurboTax Plan Prices

| Products Offered | Price | Additional State Fees |

|---|

| Free Edition | Free | Free |

| Deluxe | $59 and Up | $59 and Up Per State |

| Premier | $89 and Up | $59 and Up Per State |

| Self-Employed | $119 and Up | $59 and Up Per State |

Jun 1, 2023

Backed by our Full Service Guarantee

Review everything with your expert before they sign and file for you. They won't sign your return until they're 100% sure it's done right, guaranteed.

Why use TurboTax Free Edition? If you have a simple tax return, you can file your taxes online for free. Just import your W-2, answer basic questions about your life, and get your maximum refund, guaranteed.

TurboTax has many benefits, but not everything about the service is perfect. Downsides include higher costs compared to competitor pricing and the potential additional cost of utilizing a tax expert.

Cons: More expensive than other tax-filing software. Only those with simple tax returns (including those with only W-2 income) qualify for the free version, other situations start at $69. Live expert assistance plans start at $99.

TurboTax is generally pricier than everything else out there. While confident filers may not need all the bells and whistles that most TurboTax online products offer, some people may find the experience and the availability of human help worth the extra cost.

For software, you'll find mostly similar features, though TurboTax does a better job of importing tax details from banks, investment companies, and other software. H&R Block stands out with the option to get help from a tax professional in person, which you can't do with TurboTax.

Cons:

- More expensive than other tax-filing software.

- Only those with simple tax returns (including those with only W-2 income) qualify for the free version, other situations start at $69.

- Live expert assistance plans start at $99.

- State taxes are generally an additional cost for most paid plans.

A Quick Look at TurboTax

| TurboTax Filing Options | |

|---|

| TurboTax Free Edition | – Federal: Free – State: Free |

| TurboTax Deluxe | – Federal: $59 – State: $49 |

| TurboTax Premier | – Federal: $89 – State: $49 |

| TurboTax Self-Employed | – Federal: $119 – State: $49 |

TurboTax Free Edition – Free for Simple Returns

For the ninth year in a row, we are offering free federal and state tax filing with TurboTax Free Edition, helping millions of Americans file for free. TurboTax Free Edition is for simple tax returns only – you can see if you qualify here.

Cons of Using TurboTax:

On the other hand, a CPA can provide personalized advice and answer specific questions. Potential Errors: Although TurboTax is designed to be user-friendly, there is still a risk of input errors or misunderstandings during the data entry process.

In 2020, for example, approximately two-thirds of tax filers could not use TurboTax's free product. “TurboTax is bombarding consumers with ads for 'free' tax filing services, and then hitting them with charges when it's time to file,” said Samuel Levine, Director of the Bureau of Consumer Protection.

When to Hire a Tax Professional vs. Using TurboTax

- You're not taking the standard deduction. As a business owner, you've likely recorded many of your purchases as deductible expenses.

- Your taxes are complicated.

- Your books are sloppy.

- You've been investing.

- You don't have time.