What is Bank of America (Credit Card) Customized Cash Rewards Credit Card?

The Bank of America Customized Cash Rewards Credit Card is a rewards credit card that gives customers the opportunity to earn cash back on their purchases. The card offers a variety of benefits, including the ability to earn cash back on purchases in categories that are chosen by the cardholder.

When customers sign up for the Customized Cash Rewards Credit Card, they are given the option to choose which category they want to earn the most cash back on. The options include categories such as gas, online shopping, dining, travel, drugstores, and home improvement/furnishings. Once a category is chosen, the customer will earn 3% cash back on every purchase made in that category.

In addition to the option to earn 3% cash back on a chosen category, customers who use their Bank of America Customized Cash Rewards Credit Card also earn 2% cash back on purchases at grocery stores and wholesale clubs, and 1% cash back on all other purchases.

One of the other benefits of the Bank of America Customized Cash Rewards Credit Card is the fact that there is no annual fee. Additionally, customers have the ability to redeem their cash back at any time and for any amount. The rewards never expire, so customers can save them up over time to use for bigger purchases or can redeem them frequently for smaller rewards.

Overall, the Bank of America Customized Cash Rewards Credit Card is a great option for people who want to earn cash back on their purchases without having to pay an annual fee. With the ability to choose a rewards category and earn 3% cash back on every purchase in that category, along with 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases, this credit card offers a lot of value to customers.

Frequently Asked Questions about bank of america (credit card) customized cash rewards credit card

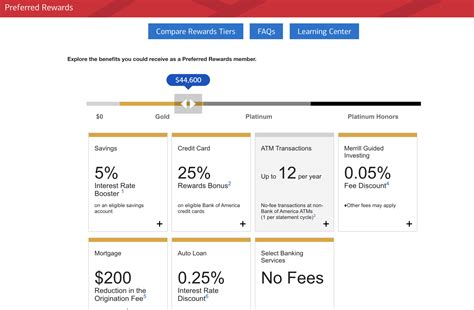

Bank of America® Customized Cash Rewards secured credit card. 3% cash back in the category of your choice, automatic 2% cash back at grocery stores and wholesale clubs (on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter) and unlimited 1% cash back on all other purchases.

The Bank of America® Customized Cash Rewards credit card earns 3% back on a category of your choice and 2% back on grocery store and wholesale club spending, on up to $2,500 per quarter in combined spending in those categories. All other purchases earn 1% back. You can change your 3% bonus category once a month.

The Bank of America Customized Cash Rewards credit card is an excellent no-annual-fee card if you think you'll earn more by maximizing the card's bonus categories rather than with a 1.5 percent flat-rate cash back card.

Earn 3% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. Use our rewards calculator to see how much cash back you can earn...

Citi Custom Cash® Card Overview

Citi's no-annual-fee credit card earns cash back rewards on purchases in one of 10 popular everyday categories but doesn't require you to keep track of categories or activation periods. Instead, you automatically earn rewards in your top spend category each billing cycle.

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The Bank of America card that gives the highest credit limit is the Bank of America® Customized Cash Rewards credit card, which has a reported maximum limit of $95,000.

Rewards credit cards offer points that can be redeemed for merchandise, flights, and more, whereas cash back cards give you a fixed dollar amount for every purchase you make. Choose a credit card based on your lifestyle and what gives you the most bang for your buck.

The credit limit for the Bank of America® Customized Cash Rewards credit card is usually at least $1,000 and can be much higher, with some cardholders reporting limits of over $50,000. Bank of America uses your income, credit profile, and other information to set your card's credit limit.

The credit limit for the Bank of America® Customized Cash Rewards credit card is usually at least $1,000 and can be much higher, with some cardholders reporting limits of over $50,000. Bank of America uses your income, credit profile, and other information to set your card's credit limit.

The credit limit for the Bank of America® Customized Cash Rewards credit card is usually at least $1,000 and can be much higher, with some cardholders reporting limits of over $50,000. Bank of America uses your income, credit profile, and other information to set your card's credit limit.

A cash card is an electronic payment card that stores cash for various types of payments. Cash cards may include bank debit cards, prepaid debit cards, gift cards, and payroll cards. They do not include credit cards since credit cards are a form of debt rather than cash.

It's just like a normal check or debit card, except you get to choose the photo or image that appears on the card.

NerdWallet's Best Bank of America Credit Cards of October 2023

- Bank of America® Customized Cash Rewards credit card: Best for Bonus category cash back.

- Bank of America® Unlimited Cash Rewards credit card: Best for Simple cash back.

- Bank of America® Travel Rewards credit card: Best for Travel.

You'll need good to excellent credit (670-850 credit score) to be eligible for credit limits as high as $100,000. Note: Business credit card limits may depend on both your personal credit score, as well as your business credit score.

Advantages and Disadvantages of Cash Back

You get cash back for spending your money, whether using your credit or debit card or even shopping online. Cash-back apps and websites may offer discounts on products along with cash-back rewards. Some credit cards with cash back offer a sign-up bonus.

Every time you use a cash-back credit card to make a qualifying purchase in store or online, it earns a percentage of the amount paid. That means if you spend $500 on a card that earns 1.5% cash back, you'll earn $7.50 back in rewards.