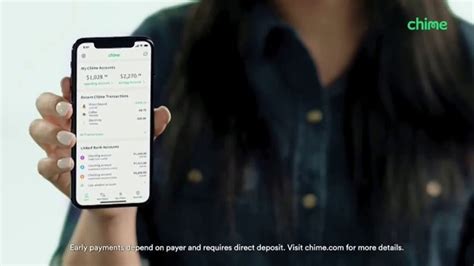

What is Chime VISA Debit Card?

Chime is an online banking platform that offers a variety of financial services, including a VISA debit card. The Chime VISA debit card is a modern and convenient way for users to access their funds, and it comes with a number of unique features that set it apart from other traditional debit cards.

One of the key features of the Chime VISA debit card is its fee structure. Unlike many traditional banks that charge various fees for different services, Chime's VISA debit card is virtually fee-free. There are no monthly maintenance fees, no overdraft fees, and no foreign transaction fees. This means that users can have more control over their money and avoid some of the common pitfalls of traditional banking.

Another notable feature of the Chime VISA debit card is its real-time notifications. The Chime app sends users instant notifications whenever a debit card transaction is made. This provides users with up-to-date information on their spending and helps them avoid fraudulent or unauthorized purchases.

In addition, the Chime VISA debit card can be used at over 30,000 fee-free ATMs across the United States. Users can also deposit checks using the Chime app, making it easy to access their funds from virtually anywhere.

Overall, the Chime VISA debit card is a reliable and modern option for those who want more control over their finances. With its fee-free structure, real-time notifications, and easy access to funds, it's a convenient way to manage money in the digital age.

Frequently Asked Questions about chime visa debit card

A Chime debit card works like any other debit card – it's connected to your bank account and allows you to pay directly from that account at merchants and get money from ATMs. You can connect the checking account to your current bank account for funding or make direct deposits to your new Chime checking account.

Chime's debit card is linked to your bank account and a prepaid card is not. So, if you use your Chime debit card, your purchases are deducted from your Checking Account. A prepaid card, on the other hand, is not connected to any bank account and it's up to you to load money onto it in advance.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC.

With Chime, you can receive direct deposits up to two days early**, earn savings interest, send payments and build credit. Chime doesn't charge monthly fees, and it offers fee-free overdraft up to $200^ to eligible customers. It's best for people who receive direct deposits and don't need to deposit cash often.

Yes, you can use your Chime card anywhere Visa is accepted, for payments and for withdrawing money from ATMs. However, you have to turn on International Transactions in your settings within the app. Chime does not charge a fee for international transactions, but there is $2.50 fee for international ATM withdrawals.

Chime is not a bank. It is a financial technology company. The banking services it offers are provided by The Bancorp Bank, N.A., and Stride Bank, N.A., both of which are FDIC members.

Your Chime Visa Debit Card works everywhere Visa debit cards are accepted.

When traveling internationally, you can use your card in most countries where Visa is accepted as long as you enable international transactions. Chime doesn't charge foreign transaction fees. To turn on international transactions in your app: Tap the gear icon to open Settings.

Chime is a financial technology company based in California that partners with The Bancorp Bank, N.A., and Stride Bank, N.A., to offer financial products. Both of the banks Chime partners with are FDIC members. Chime is known for offering low-cost accounts that do not include overdraft fees or monthly maintenance fees.

Yes, you can use your Chime card anywhere Visa is accepted, for payments and for withdrawing money from ATMs. However, you have to turn on International Transactions in your settings within the app. Chime does not charge a fee for international transactions, but there is $2.50 fee for international ATM withdrawals.

You might be wondering, “What bank is Chime?” Chime is not a bank but a financial technology company. Our mission is to offer people financial features that help them, like access to paychecks up to 2 days early3 with direct deposit, fee-free overdrafts of up to $200,4 and accounts with no monthly service fees.

Can I use my Chime card abroad? Yes, you can use your Chime card anywhere Visa is accepted, for payments and for withdrawing money from ATMs. However, you have to turn on International Transactions in your settings within the app.

Note: All members must be a U.S. citizen and at least 18 years of age. Chime offers an online bank account and a mobile banking app. You can download the app for free from the Google Play Store or Apple App Store.

When traveling internationally, you can use your card in most countries where Visa is accepted as long as you enable international transactions. Chime doesn't charge foreign transaction fees. To turn on international transactions in your app: Tap the gear icon to open Settings.

United States

Chime (company)

| Type | Private |

|---|

| Industry | Financial services |

| Founded | 2012 |

| Founders | Chris Britt and Ryan King |

| Headquarters | San Francisco, California, United States |

ATMs: You can withdraw up to $515 per day at any ATM. There is a $2.50 fee every time you make a withdrawal from an out-of-network ATM. Additionally, the out-of-network ATM provider may charge you an additional fee at their discretion.