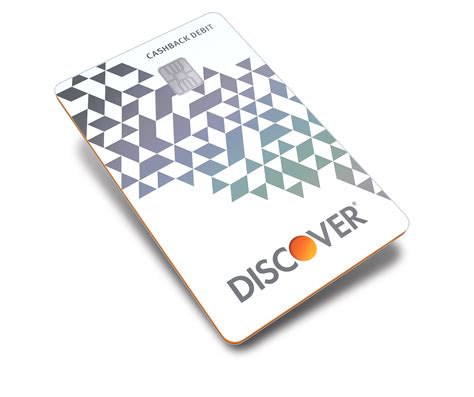

What is Discover Card Discover Cashback Debit Card?

Discover Cashback Debit Card is a popular debit card offered by Discover Financial Services, a major credit card issuer in the United States. The card comes with a range of benefits, including cashback rewards, zero monthly fees, and access to over 60,000 ATMs across the US.

One of the most important features of the Discover Cashback Debit Card is the cashback rewards program. Cardholders can earn up to 1% cashback on purchases made using their card. This cashback can be redeemed for various rewards, including cash, gift cards, and merchandise.

Another great feature of the Discover Cashback Debit Card is the lack of monthly fees. Unlike many other debit cards, there are no monthly maintenance fees or minimum balance requirements associated with the Discover Cashback Debit Card.

In addition, the card offers other perks such as free online bill pay, 24/7 customer service, and fraud protection. Cardholders can also qualify for debit card rewards for specific activities such as online bill pay and direct deposit.

Overall, the Discover Cashback Debit Card is an excellent option for those looking for a cash-back rewards program without any monthly fee. Whether you’re using it for shopping, online transactions, or ATM withdrawals, the Discover Cashback Debit Card is a reliable and rewarding option.

Frequently Asked Questions about discover card discover cashback debit card

You can use a debit card to pay for things in person and online or to withdraw cash directly from your account via an ATM.

The Discover Cashback Debit Account could be a lucrative option for those who frequently use their debit card. With cash back on every purchase, it's possible to earn even more than you could with a typical checking account APY without changing your habits at all.

Discover Bank

A subsequent innovation was "Cashback Bonus" on purchases. Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network.

- Credit Cards.

- Online Banking.

- Personal Loans.

- Student Loans.

- Home Equity Loans.

- Mortgage Refinance.

- Diners Club International.

- PULSE.

You can withdraw money from your Discover Cashback Debit Account in the following ways: No-fee cash withdrawals at over 60,000 Allpoint® and MoneyPass® ATMs. Please note that not all ATMs are available 24/7 - hours may vary at each location. Use online and mobile ATM Locators to find a no-fee ATM near you.

Staying true to its roots, the card still has no annual fee and doesn't charge foreign transaction fees. Discover won't charge a late fee for the first missed or late payment, either. 9 Each of your monthly statements also comes with a free FICO score.

With Discover Cashback Debit, you can earn 1% cash back on up to $3,000 in debit card purchases each month. 1. That's up to $360 a year. Not too bad for just going about your daily debit card spending.

You can easily withdraw money daily with the Discover Cashback Debit Account at an ATM or at the register at participating retailers. You can also send and receive money in minutes with Zelle. However, the daily ATM withdrawal limit for each account is the lesser of $2,000 or your available balance.

With Discover Cashback Debit, you can earn 1% cash back on up to $3,000 in debit card purchases each month. That's up to $360 a year. Not too bad for just going about your daily debit card spending. To make the process of saving that extra cash even easier, consider opening a Discover Online Savings Account.

A contactless debit card from Discover helps you make fast, easy, and secure payments at checkout where contactless payments are accepted. Easy - Simply tap your Discover Debit Card at merchants nationwide where contactless payments are accepted.

The bottom line: Discover Bank® checking lets you earn cash back when you make qualifying debit card purchases each month, and it provides free access to a broad ATM network. The online bank also offers a strong high-yield savings account.

With cash advance into checking, you can transfer cash from your Discover Card directly into your checking account.

For example, you can send money with a Discover credit card, but you're likely to only be able to send to accounts you've used to pay off your bill in the past¹. If you've got Discover online banking, you'll be able to make local and international wire transfers, too².

The Discover it® Cash Back Credit Card allows cardmembers to earn 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, and gas stations, up to the quarterly maximum when you activate. Plus, earn 1% cash back on all other purchases – automatically.

With your Discover it card, you automatically earn unlimited 1% cash back on all purchases. Earn 5% cash back at different places each quarter, when you activate.

Can I get cash at an ATM using my Discover Card? Yes! To get cash at an ATM, all you need is your Discover Card and your PIN. If you don't know your PIN, create or change your PIN here.