What is QuickBooks Smart Invoice?

QuickBooks Smart Invoice is a feature that is designed to streamline the billing and invoicing process for small businesses. This feature allows users to create personalized invoices, apply discounts, track payments, and get insights on their customers' payment behavior.

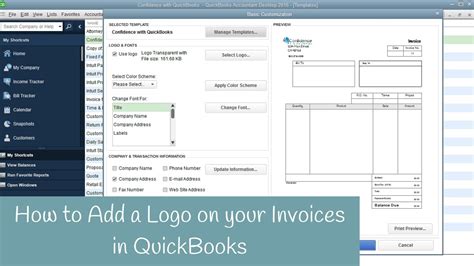

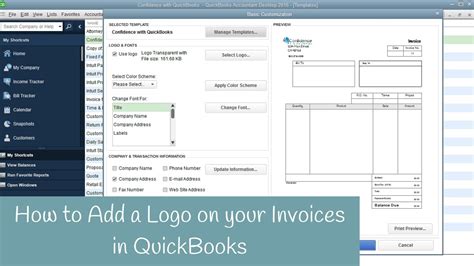

With a few simple clicks, users can create an invoice template that is tailored to their business needs. The template can be customized with a logo, color scheme, and payment terms. Users can also add their customer's information, products or services being offered, and any applicable taxes.

One of the most exciting things about QuickBooks Smart Invoice is that it allows users to offer discounts to their customers. This feature can help to boost customer retention and encourage timely payment.

Another key benefit of QuickBooks Smart Invoice is that it tracks payments in real-time and sends notifications to users when payments are made. This saves users time and provides them with visibility into their cash flow.

Moreover, QuickBooks also provides insights on customer payment behavior. Users can see which customers are paying on time, who is consistently late, and how much money is owed to them.

In conclusion, QuickBooks Smart Invoice is a powerful invoicing tool that can save businesses time and help them to streamline their billing process. With its comprehensive features, powerful tracking capabilities, and customized templates, it is an excellent choice for small business owners.

Frequently Asked Questions about quickbooks smart invoice

You use the invoice to record sales transactions from customers who make no or partial payment during the time of the sale. Invoices help you keep track of your accounts receivable. Depending on your transaction with a customer, you can create an invoice in QuickBooks Desktop in different ways.

What Is QuickBooks? QuickBooks is a full-featured business and financial management suite complete with tools for accounting, inventory, payroll, tax filing, invoicing, bank account tracking and reconciliation, expense management, budgeting, payment processing, and accounts receivable and accounts payable management.

With QuickBooks' simple yet professional invoicing software, you'll always have the right tech at your fingertips to easily create, send and track your invoices - whether that's from your desktop or on the app.

An invoice is a document used to notify a customer that payment is due. It also serves as a record for the issuing business so that it can track its receivables. In the past, invoices were only issued on paper due to the limitations of technology.

The invoice must describe each product or type of service rendered. The cost of each individual item or service must be included. The taxable amount for the products or services must be included. The total amount due for payment must be clearly included in the invoice.

And you'll notice in the columns here you have the date the invoice number. And then you have the amount and the customer balance. And in this report it's going to show the invoices.

Here Are Some Amazing Benefits of QuickBooks For Your Business

- QuickBooks Allows You to Create and Track Invoices Easily.

- QuickBooks Keeps Track of Expenses and Bills Automatically.

- QuickBooks Is Intuitive.

- QuickBooks Has an Automated Backup Service.

- QuickBooks is Customer-Oriented.

What is QuickBooks and How Does it Work? QuickBooks by Intuit is small business accounting software that helps to manage income and expenses and track the financial position. QuickBooks use for enables the user to invoice customers, pay bills, prepare taxes, and generate financial reports.

QuickBooks Desktop and QuickBooks Online are accounting software, only, and don't include the broader range of business functions that ERP software typically offers.

Accounting software

QuickBooks

| Developer(s) | Intuit Inc. |

|---|

| Stable release | 2023 |

| Operating system | Microsoft Windows macOS (USA only) |

| Type | Accounting software |

| License | Proprietary |

Invoices remind clients of the work completed or goods provided. It's an itemised bill, so customers can see what they're getting for their money. They're a useful record-keeping tool.

5 Must-Have Features of your Small Business Invoice

- Your contact details.

- Payment Information.

- Some terms and conditions.

- An invoice / reference number.

- A breakdown of costs.

Elements of an invoice

- The word "INVOICE"

- Invoice number.

- Date of service rendered.

- Date of sending invoice.

- Contact and name of org / seller.

- Name and contact of buyer.

- Terms and conditions.

- A line detailing each product or service.

Here's a few common statuses that you might see on invoices:

- Open: the invoice has an open balance.

- Not sent: you created the invoice, but didn't send it to the customer.

- Sent: you emailed the invoice to the customer.

- Viewed: your customer opened the invoice.

- Partially paid: your customer made a partial payment.

With QuickBooks you can send invoices with options for customers to send you an online payment. Customers can pay by credit, debit, Apple Pay, PayPal, Venmo, or ACH bank payments. Payments will be deposited automatically, and if you have QuickBooks Online, your books will be updated.

Features

- Invoicing. Create professional custom invoices, send payment reminders, and match payments to invoices, automatically. Learn more.

- Expenses. Get set for tax time with all your expenses organised in one place.

- Bank Feeds. Save time and reduce errors when you connect your bank to get a full view of your finances.