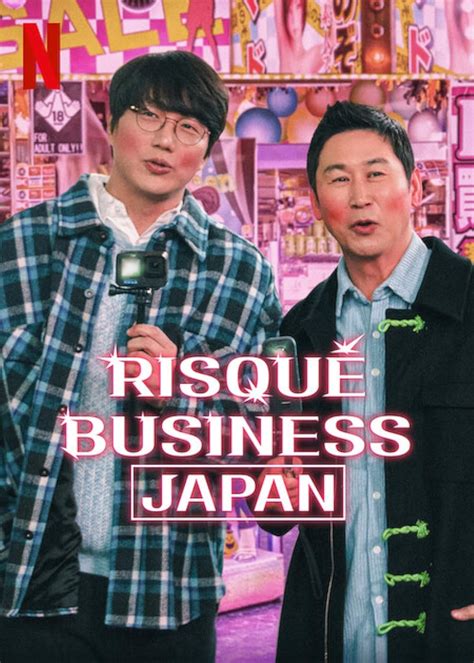

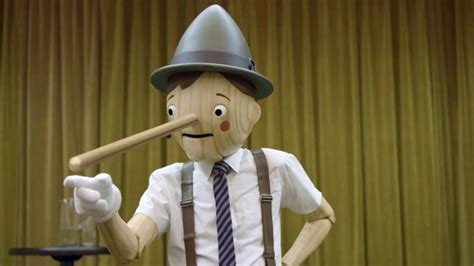

GEICO Car Insurance tv commercials

TV spots

TV commercials GEICO Car Insurance

Advertisers

Advertisers of commercials featuring GEICO Car Insurance

Esurance

Esurance is an online insurance company that specializes in providing auto insurance coverage. It is a subsidiary of Allstate, one of the largest insurance providers in the United States. Esurance of...

GEICO

What is GEICO?GEICO (Government Employees Insurance Company) is an American auto insurance company headquartered in Chevy Chase, Maryland. It was founded in 1936 by Leo Goodwin Sr. and his wife Lillia...

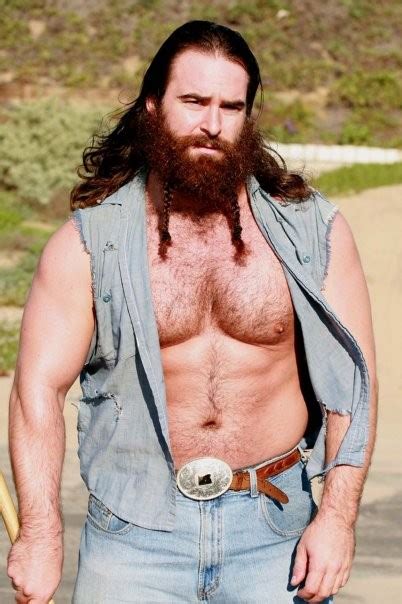

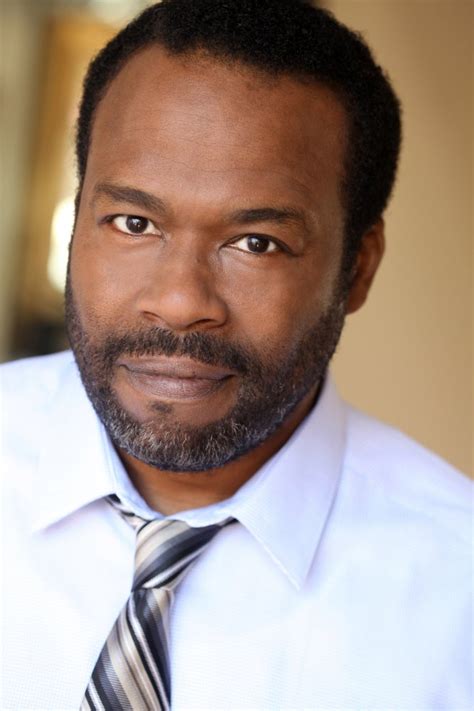

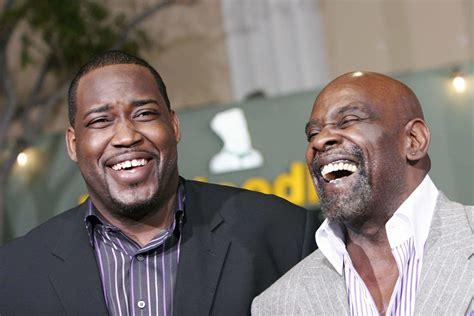

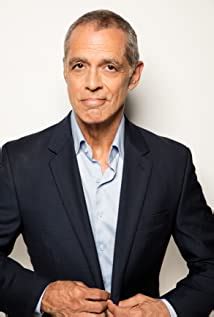

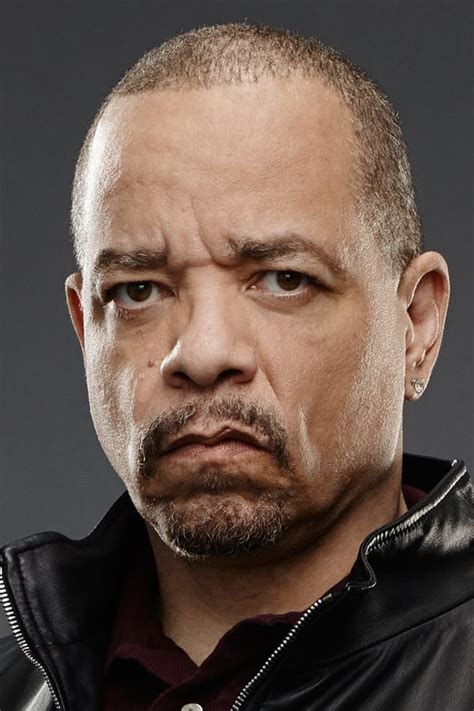

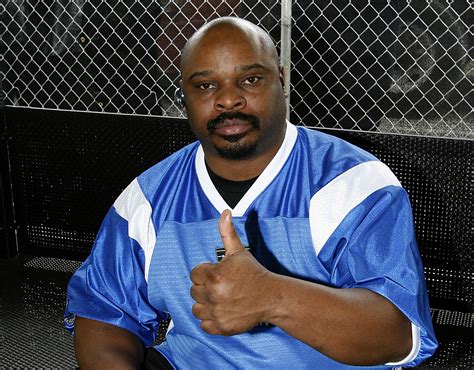

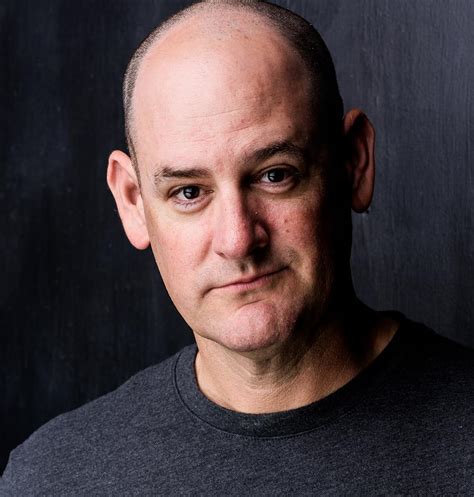

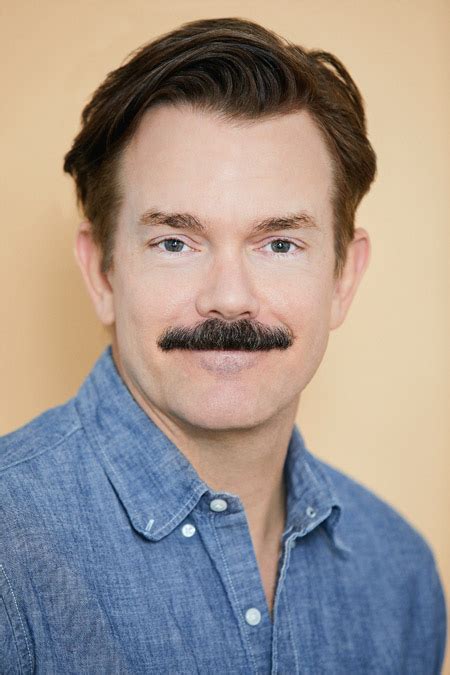

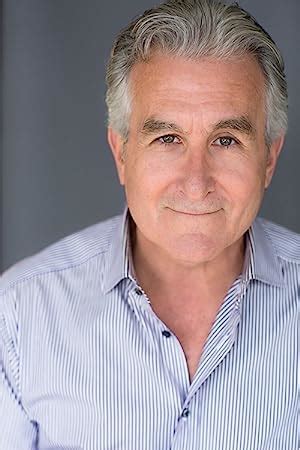

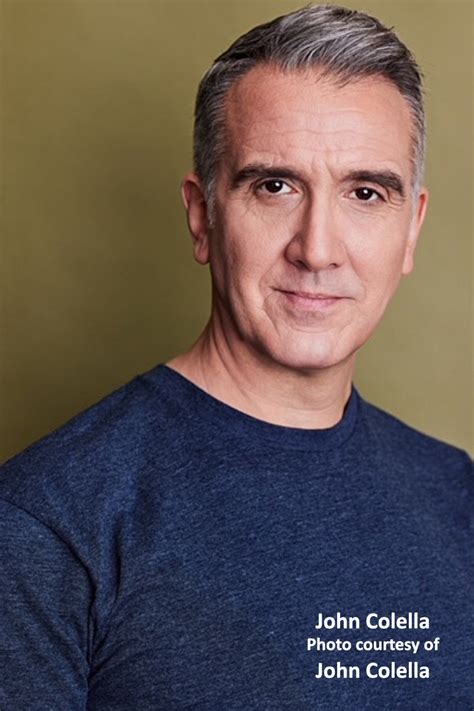

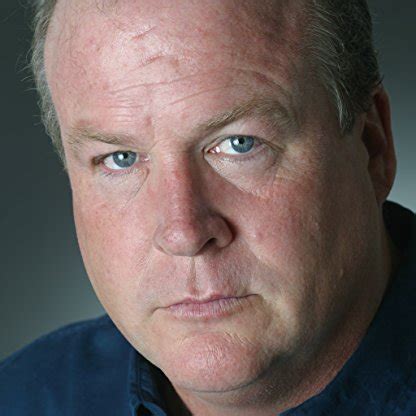

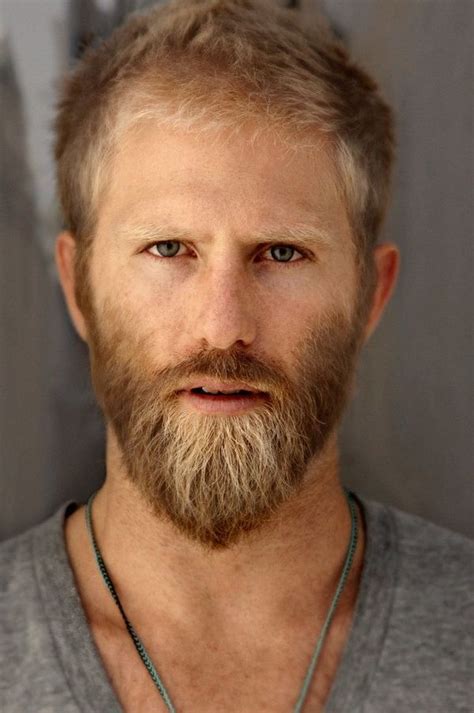

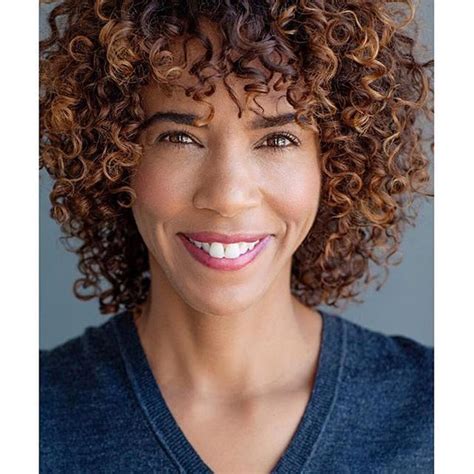

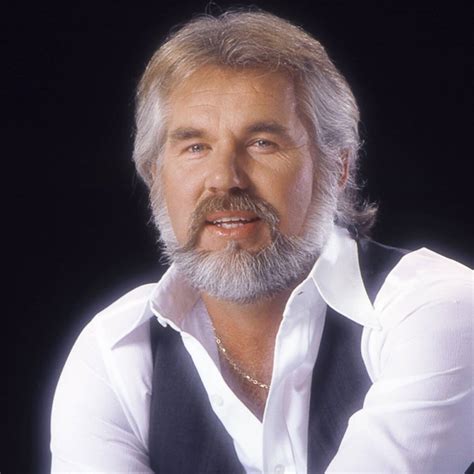

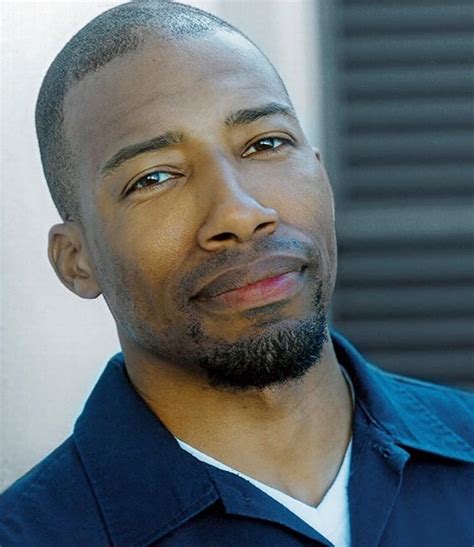

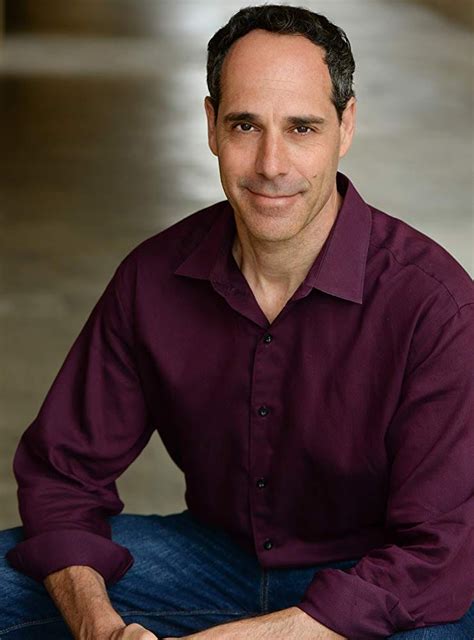

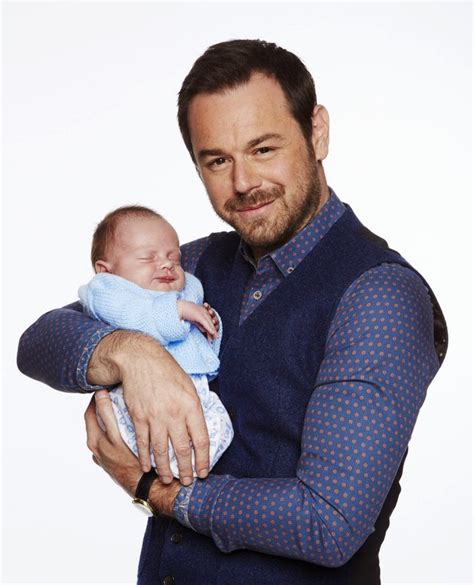

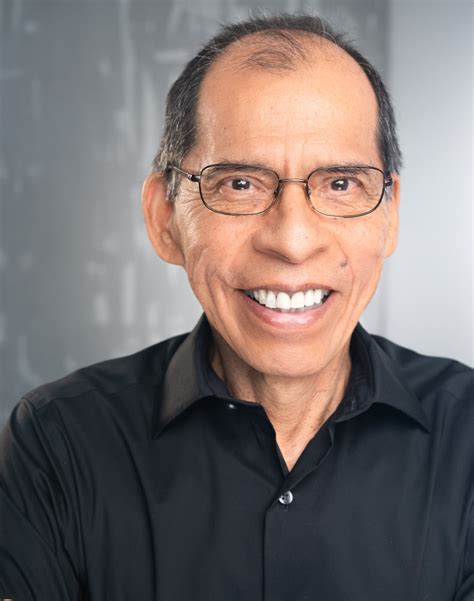

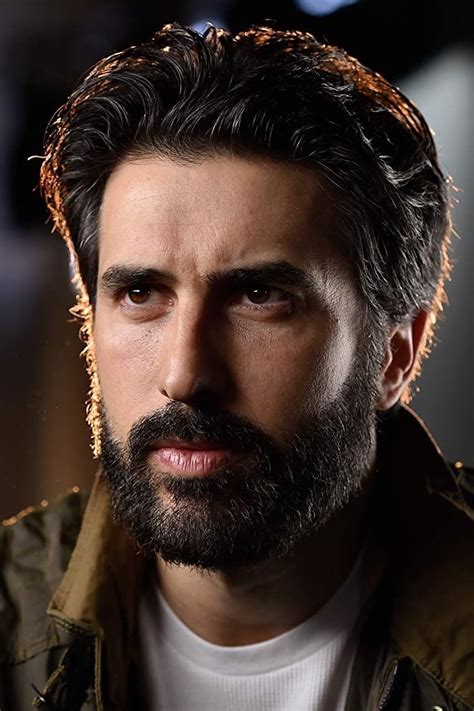

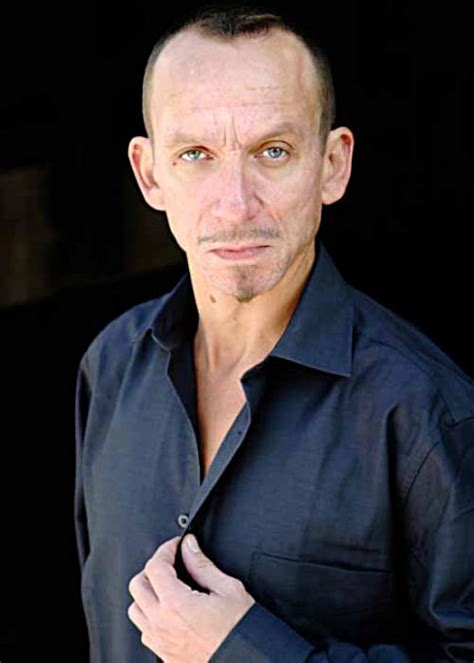

Actors

Actors who starred in GEICO Car Insurance commercials

Agenices

Agencies worked with GEICO Car Insurance

Horizon Media, Inc.

Hungry Man

Leo Burnett

Media Contacts (MPG)

Mediabrands

Radical Media

Smuggler

Starcom

The Martin Agency

What is GEICO Car Insurance?

GEICO, short for Government Employees Insurance Company, is one of the largest car insurance companies in the United States. Founded in 1936 by Leo Goodwin, Sr., GEICO has grown to become a leading provider of car insurance across the country.

One of the unique features of GEICO's car insurance policies is its offering of affordable rates. The company's advertising campaign famously states that customers can save "15% or more on car insurance" by choosing GEICO. This low-cost model has been particularly attractive to drivers who are looking for basic coverage at an affordable price.

Despite their competitive pricing, GEICO provides a range of coverage types, including liability, collision, and comprehensive coverage. They also offer extras like roadside assistance, rental car reimbursement, and mechanical breakdown insurance.

GEICO has also made it easier for customers to access their accounts and file claims, providing a user-friendly website and app. The company has even introduced virtual assistants to streamline the claims process further.

In addition to car insurance, GEICO offers insurance for other types of vehicles, including RVs, motorcycles, boats, and personal watercraft. They also offer homeowners, renters, and life insurance policies, making it a one-stop-shop for customers looking for different types of insurance coverage.

Overall, GEICO is a reliable option for drivers looking for affordable car insurance policies. With a range of coverage options and user-friendly customer service, GEICO provides quality coverage without breaking the bank.